CAM Investment Grade Weekly Insights

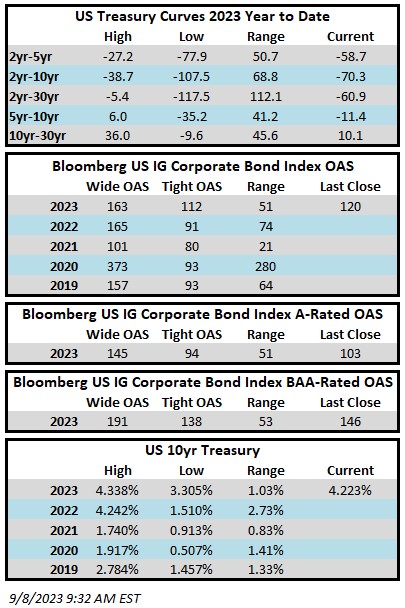

Investment grade credit spreads are slightly wider this week, although spreads for many individual corporate bonds are unchanged. The Bloomberg US Corporate Bond Index closed at 120 on Thursday September 7 after having closed the week prior at 119. The 10yr is trading at 4.22% this morning, higher by 4 basis points on the week. Through Thursday, the Corporate Index YTD total return was +1.76%.

The holiday shortened week was a light one as far as economic data was concerned. Next week brings much more meaningful data with CPI on Wednesday, Retail Sales and Core PPI on Thursday and Industrial Production numbers on Friday. The FOMC enters media blackout tomorrow ahead of its next meeting and rate decision on September 20.

In contrast to economic data, the calendar for new issuance was anything but quiet. Things got off to a hot start the first trading day of the week as 20 issuers blitzed the market, pricing $36.2bln in new debt. It was the busiest day for the primary market in more than three years.[i] This momentum carried into Wednesday and Thursday pushing the weekly total past $55bln. Syndicate desks are expecting $30bln in supply next week, with Monday and Tuesday expected to be busy as issuers look to price debt ahead of Wednesday’s CPI print.

According to Refinitiv Lipper, for the week ended September 6, investment-grade bond funds reported a net outflow of -2.1bln. Flows for the full year are a net positive +$23.5bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.

[i] Bloomberg, September 5 2023, “IG ANALYSIS: 20 Price $36bn in Busiest Day in More Than 3 Years”