CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

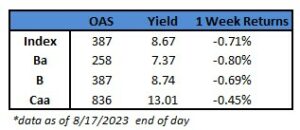

- US junk bonds are headed toward their worst weekly loss since June after steadily falling for five straight sessions. Thursday’s loss of 41% is the biggest one-day slide in six weeks as yields rose 10 basis points to a more than five-week high of 8.67%.

- Risk appetite softened after minutes of the last Fed meeting indicated that the Fed was not done with raising interest rates. The BB index is on track for the biggest weekly loss since February, with week-to-date negative returns at 0.8%.

- BB yields soared to a five-month high of 7.37%. CCCs may also end the week with the biggest loss in six.

- The Fed minutes did not give a definitive steer on the next rate decision in September, saying future moves “should depend on the totality” of incoming data and its implications for the outlook.

- Wary investors pulled cash from US high yield funds, with an outflow of $1.09b for week ended August 16. This is the fourth consecutive week of outflows from the asset class.

- The June to July rally in junk bonds, fueled by easing inflation pressures and on expectations that the Fed was nearing the end of the rate-hiking cycle, pulled US borrowers out of the sidelines.

- Light primary activity, still solid corporate fundamentals, and broad shifts in index quality and sector composition have all contributed to relatively tight spreads, Amanda Lynam, head of macro credit research at BlackRock Financial Management, wrote last week.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.