CAM Investment Grade Weekly Insights

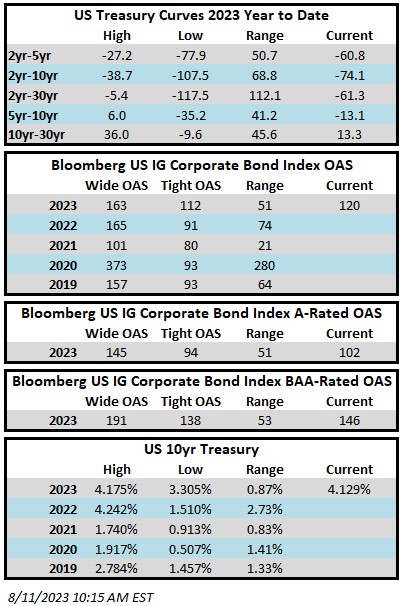

Investment grade credit spreads were slightly softer this week. The Bloomberg US Corporate Bond Index closed at 120 on Thursday August 10 after having closed the week prior at 118. The 10yr is trading at 4.13% as we go to print which is up 10 basis points on the week on the back of a PPI print that came in hotter than expected at 8:30 on Friday morning. Through Thursday August 10 the Corporate Index YTD total return was +2.11%.

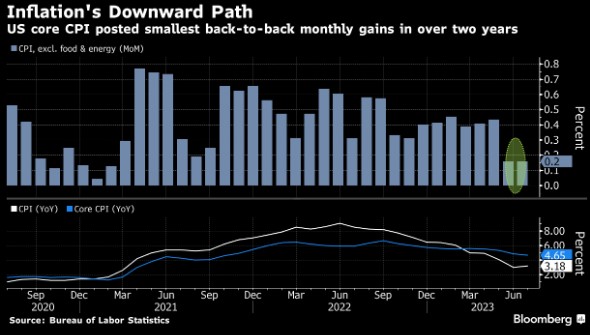

The main economic events this week were CPI and PPI on Thursday and Friday, respectively. US Core CPI posted its two smallest consecutive increases in two years.[i] While it is a step in the right direction, it is important to note that it was still an increase of +0.2% in the core number. The Friday PPI release painted a picture that was a little less encouraging as far as inflation is concerned with the headline number coming in slightly hotter than expected. Prices for services rose the most in a year but altogether the MoM increase was just +0.3% which is in line with pre-pandemic PPI numbers. Next week is a quieter one for economic data with the highlights being retail sales and housing starts. Recall that the Fed does not meet until September 20 and it remains to be seen if they will pause or hike. Interest rate futures this Friday morning are pricing in just a +11% probability of a hike at this point.

The new issue calendar exceeded expectations for the second week in a row as issuers priced $35bln in new debt after printing a similar amount last week. Next week has the potential to be another solid week ahead of the seasonal slowdown into month end. There has been $840bln of issuance year-to-date which is in line with 2022’s pace.

According to Refinitiv Lipper, for the week ended August 9, investment-grade bond funds reported a net inflow of +$0.217bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.