CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds rebound from last week’s losses and are headed to post the biggest weekly gain since mid-July. After steadily rallying for five straight sessions buoyed by a subdued consumer inflation reading, expectations are rising that the Federal Reserve will pause its interest-rate hiking campaign. The current wave of disinflation has legs, primarily reflecting the lagged impact of past Fed hikes and a downshift in economic activity, wrote Bloomberg economists Anna Wong and Stuart Paul on Thursday.

- The rally in junk bonds gained momentum after the smallest back-to-back gains in US consumer prices in more than two years.

- Philadelphia Fed President Patrick Harker said the US central bank may be able to cease interest-rate increases, barring any surprises in the economy. Richmond Fed President Thomas Barkin said it was too soon to say whether another rate increase at the Fed’s next meeting in September would be appropriate.

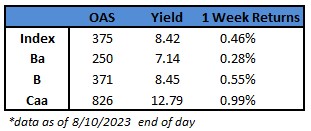

- The gains spanned across all high yield ratings, with CCCs, the riskiest of junk bonds, also recovering from last week’s losses to post gains of 0.99% week-to-date, the biggest since mid-July.

- CCC yields tumbled 26 basis points on Thursday to close at 12.79% after dropping in the three of the last four sessions. Yields fell 21 basis points for the week.

- BBs ended the two-week losing streak, with week-to-date returns of 0.28%.

- Goldman Sachs strategists led by Lotfi Karoui and Michael Puempel assess the near-term risks from corporate debt on US economy and markets, and conclude that risks are manageable and are unlikely to present any systemic risk.

- The rally also drove the primary market, with the week-to-date volume at almost $5b pushing the month-to-date tally to more than $7b.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.