CAM Investment Grade Weekly Insights

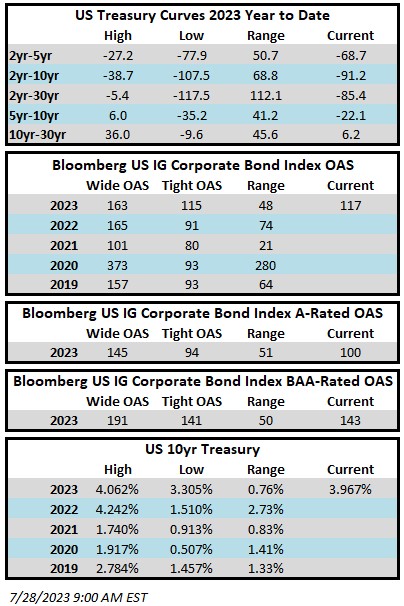

Investment grade credit spreads look set to end the week better as the index is closing in on its tightest levels since early February and is now just 2 basis points from its 2023 tight. The Bloomberg US Corporate Bond Index closed at 117 on Thursday July 27 after having closed the week prior at 122. The 10yr Treasury is currently higher on the week on the back of a hawkish adjustment by the BOJ to its yield curve control policies that took investors by surprise and sent global yields higher. The 10yr is trading at 3.97% as we go to print relative to its 3.83% close last Friday. Through Thursday July 27 the Corporate Index YTD total return was +2.90%.

Central banks took the stage this week. The Fed kicked things off on Wednesday with a 25bp rate hike that was in line with expectations. The Fed does not meet in August but Chairman Powell will be speaking at the end of next month during the Jackson Hole Economic Symposium. Chairman Powell left the door open for an additional hike in September but reiterated that the committee will be data dependent in lieu of providing explicit forward guidance. Fed funds futures are currently pricing a 19% probability of a hike at the September meeting. The ECB followed on Thursday with a balanced message and a 25bp hike. ECB President Lagarde said officials have an “open mind” regarding a September rate decision. Finally, on Friday morning, the BOJ took investors by surprise by effectively abandoning its yield curve control policies. This sent global rates higher across the board.

On the economic front, the data was mixed. US GDP for the second quarter was very strong relative to expectations, with the economy growing +2.4% versus the +1.8% estimate. On Friday, core PCE was released which is the Fed’s preferred inflation gauge. Core prices increased by +4.1% which was less than expectations and the smallest increase since 2021. The same PCE report showed some strength in consumer spending, which taken together with strong GDP and slowing inflation has reinforced the view of those in the soft landing camp that believe the Fed can bring down inflation without forcing the economy into recession.

It was a busy week for corporate earnings which means it was a slow week for issuance as volume came in just under $15bln which was light relative to the $20-$25bln estimate. Next week, market participants are looking for around $20bln in issuance but there are still plenty of companies working through earnings blackout periods. Investor demand for new bonds has been extremely strong which has caused concessions to evaporate. Issuance should start to pick up the week after next as corporate borrowers look to tap into this demand. The calendar will start to accelerate in the seasonally strong period that follows Labor Day. There has been $769bln of issuance year-to-date which trails 2022’s pace by -3%.

According to Refinitiv Lipper, for the week ended July 26, investment-grade bond funds collected +$1.151bln of cash inflows. This was the 8th consecutive week of inflows and net flows for the year now stand at nearly $30bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.