CAM Investment Grade Weekly Insights

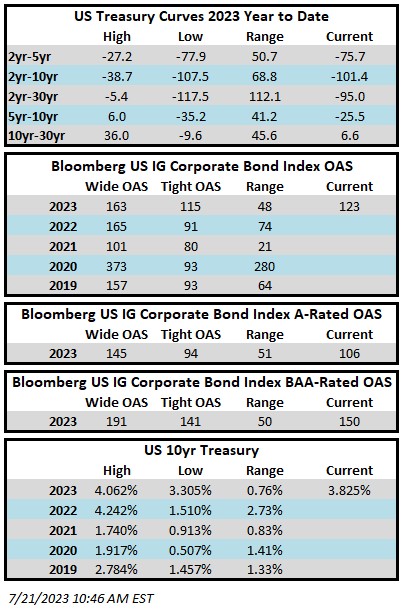

Investment grade credit spreads may end the week slightly tighter but the theme for spreads lately has been one of little change. In fact, for the month of July, the spread on the index has been range bound within a tight window of 122-125. The Bloomberg US Corporate Bond Index closed at 123 on Thursday July 20 after having closed the week prior at 124. The 10yr Treasury is currently 3.83% which is exactly where it closed the week prior. Through Thursday July 20 the Corporate Index YTD total return was +3.45%.

There were a few economic releases of note during the week. Retail sales rose modestly, showing signs of deceleration. Data showed that housing starts slowed in June but were in line with expectations. Permits to build one-family homes increased in June and are now at a one-year high, which should provide some support for housing starts in future months. Finally, jobless claims came in light relative to expectations, as the labor market remains stubbornly tighter than the Fed would prefer. Next week brings plenty of action with a Fed rate decision on Wednesday and the same from the ECB on Thursday. The BOE will have to wait until August 3rd. The current consensus view is that each of the three aforementioned central banks will hike by 25bps.

It was an odd week for issuance in that it felt pretty light in terms of the number of deals but the dollar amount of issuance was impressive for this time of year, topping $30bln. The big issuers this week were Morgan Stanley with a $6.75bln 4 part offering and Wells Fargo with an $8.5bln two tranche offering. Next week, prognosticators are looking for another $25-30bln in issuance. There has been $744bln of issuance year-to-date.

According to Refinitiv Lipper, for the week ended July 19, investment-grade bond funds collected +$2bln of cash inflows.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.