CAM Investment Grade Weekly Insights

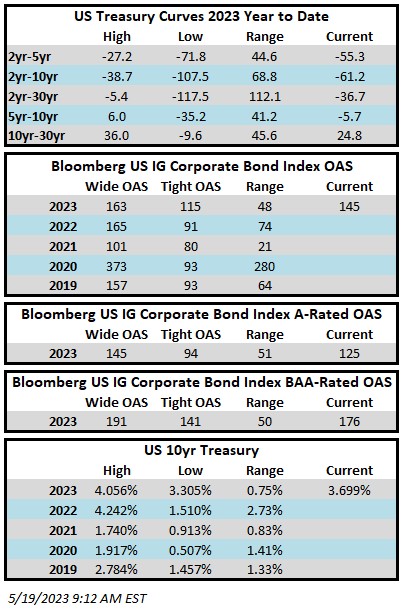

Investment grade credit spreads drifted wider through the first half of the week and into Wednesday’s close on the back of new issue supply. Spreads then snapped tighter Thursday afternoon on the hope that there could be a near term resolution to the debt ceiling. After the move tighter, spreads were unchanged on the week –the Bloomberg US Corporate Bond Index closed at 145 on Thursday May 18 after having closed the week prior at the same level. The market eagerly awaits comments and a Q&A session with Jerome Powell and Ben Bernanke at 11 a.m. Friday morning. Rates across the board were higher this week, and yields are the highest they have been since early March. The 10yr Treasury is trading at 3.69% as we go to print after closing the prior week at 3.46%. Through Thursday, the Corporate Index had a YTD total return of +2.16%.

It was a relatively light week for economic data with no real surprises in retail sales data, housing starts or initial jobless claims. As we mentioned previously, it seems that the possibility of a weekend agreement on the debt ceiling has been the catalyst for higher Treasury yields. Fed Funds futures are currently pricing in a +31.6% chance of a hike at the June 14 meeting but there will be plenty of data points between now and then that could change that picture. Big economic releases next week include GDP, personal spending/income and core PCE.

It was a big week for issuance with nearly $60bln in new supply with Pfizer leading the way as it printed an 8-part $31bln deal to fund its acquisition of Seagen. The Pfizer deal was the 4th largest bond deal of all time and the largest deal since CVS priced $40bln to fund its acquisition of Aetna in March of 2018. Pfizer was priced with attractive concessions to incent demand and all eight tranches of the deal are trading tighter than where they priced on Tuesday afternoon.

Also of note, Schwab printed $2.5bln of new debt this week which, in our view, indicates that investors have regained some comfort around the ability of the regional banking sector to persevere. Issuance thus far in the month of May has not disappointed with $123bln in supply month to date. Year to date supply is $584bln. Next week, new issuance will likely be front-end loaded as the market has a 2pm early close on Friday ahead of the Memorial Day weekend.

According to Refinitiv Lipper, for the week ended May 17, investment-grade bond funds saw +$2.163bln of cash inflows. This was the second consecutive inflow after funds collected +$1.43bln last week.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.