CAM Investment Grade Weekly Insights

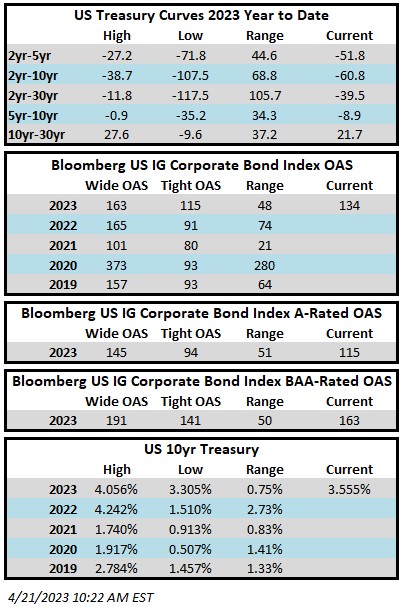

Investment grade credit spreads drifted sideways this week and if that trend holds then it looks likely that the index will finish the week unchanged. The Bloomberg US Corporate Bond Index closed at 134 on Thursday April 20 after having closed the week prior at 134. The 10yr Treasury traded in a narrow range this week and the yield is 3.55% as we go to print which is 4 basis points higher than its closing level last Friday. Through Thursday the Corporate Index had a YTD total return of +3.93% while the S&P500 Index return was +8.1% and the Nasdaq Composite Index return was +15.5%.

This was the first week in a while where there wasn’t an economic data point that had a significant impact on spreads or rates. Most of the data that was released this week was in-line with expectations, including housing starts and initial jobless claims. The market firmly expects a +25bp rate hike at the May 3rd FOMC meeting. Fed funds futures are currently pricing the probability of a hike at +92.4%, a 10% increase from last Friday. The Fed media blackout starts this Saturday and we welcome the 1.5 week reprieve from parsing every word from each of the 12 FOMC members.

The primary market had a busy week as issuers priced $28.85bln of new debt through Wednesday versus the high end of projections that called for just $15bln. There was no issuance on Thursday or Friday. Banks were expected to deliver this week and they did so in a big way with BofA and Morgan Stanley printing $8.5bln and $7.5bln, respectively. BNY Mellon and Wells Fargo also tapped the market. Although this week was strong, April as a whole has been underwhelming with just under $49bln of new debt being priced thus far relative to projections that were calling for more than $100bln at the beginning of the month. Forecasts are calling for $10-$15 billion of issuance next week, so it looks unlikely that we will approach that $100bln monthly figure with just 5 trading days remaining.

According to Refinitiv Lipper, for the week ended 4/19/2023, Investment-grade bond funds collected +$1.14bln of cash inflows.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.