CAM Investment Grade Weekly Insights

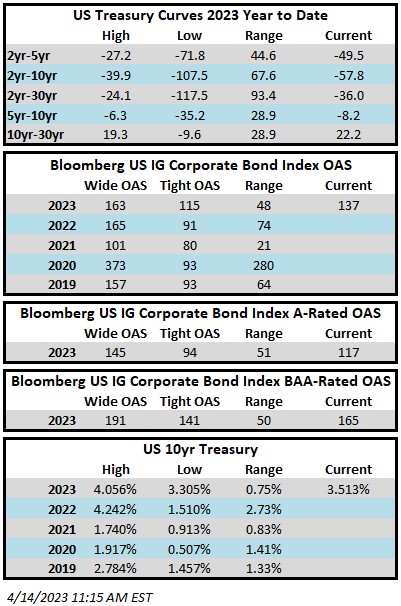

Investment grade credit spreads will likely finish the week tighter. The Bloomberg US Corporate Bond Index closed at 137 on Thursday April 13 after having closed the week prior at 141. The 10yr Treasury is trading at 3.51% as we go to print which is 20 basis points higher than the YTD low at the close last Thursday. Through Thursday the Corporate Index had a YTD total return of +3.99% while the S&P500 Index return was +8.5% and the Nasdaq Composite Index return was +16.5%.

It was a busy week for economic data. On Wednesday there was a much anticipated CPI release that showed that inflation slowed slightly. On Thursday we got a PPI release as well as Initial Jobless Claims and both painted a picture of a slowing economy. Finally, on Friday we got a Retail Sales release that showed that, while sales slowed, the control group performed better than expected. The control group feeds into PCE which is the Fed’s preferred inflation gauge. All told, the data showed that inflationary pressures are easing and the economy is cooling but likely not enough to dissuade the Fed from at least one additional hike at its upcoming meeting. Fed Funds Futures implied an 83.6% chance of a hike at the May 3rd meeting as we went to print.

The primary market met the low end of expectations this week as just under $11bln in new debt was printed. Walmart led the way with a $5bln 5-tranche deal. Next week’s issuance forecasts are all over the map and range from $10-$25bln. This is because the bulk of issuance next week is expected to be from the banking industry and they may elect to tap the market in size or management teams may instead may wait for volatility in financials to further subside.

According to Refinitiv Lipper, Investment-grade bond funds collected $1.13bln of cash inflows after $1.79bln was added in the prior week.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.