CAM Investment Grade Weekly Insights

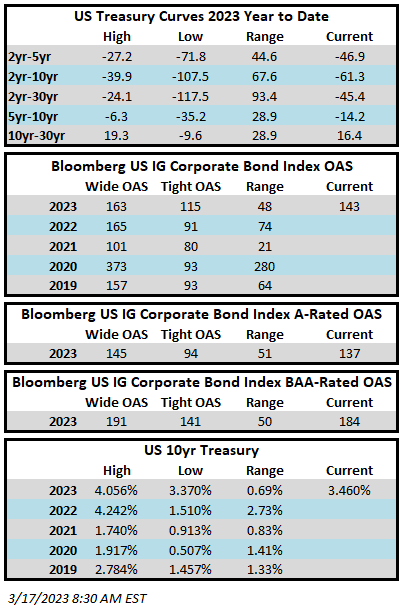

Investment grade credit spreads will finish the week wider amid an extremely volatile tape. The Bloomberg US Corporate Bond Index closed at 143 on Thursday March 16 after having closed the week prior at 136. The 10yr Treasury is wrapped around 3.46% as we go to print which is 23 basis points lower than where it closed the prior week. Through Thursday the Corporate Index had a YTD total return of +1.69% while the YTD S&P500 Index return was +3.6% and the Nasdaq Composite Index return was +11.9%.

The volatility over the past week has really been something to behold. Few things are worse for risk assets than problems in the banking sector, which is the foundation of the global economy. The failures of Silicon Valley Bank and Signature Bank are highly idiosyncratic in nature and not representative of systemic issues in our view. Treasury Secretary Janet Yellen put it best in her testimony yesterday when she remarked that those particular banks had been grossly mismanaged. As far as our banking exposure is concerned, we have a high degree of confidence in the banks that populate our investment grade portfolio. Our approach to the banking industry has always been to focus on well capitalized institutions that have broadly diversified revenue streams and geographically diverse lending footprints. The very nature of our methodology excludes regional banks and specialty banks because their loan portfolios are either too specialized or the footprint is too concentrated. All of CAM’s banking exposure is confined to the 15 largest banks in the U.S. We believe that the Federal Reserve will do whatever it takes to restore confidence and stability in the banking sector.

The primary market was totally closed this week which is unsurprising given the volatility in spreads and rates. According to Bloomberg, this was the first week with no investment grade primary deals since June of 2022. This is a testimony to how infrequently the IG market is “closed” to issuers. We actually believe high quality companies could have issued this week if they had wanted to as demand for credit in the secondary market was still quite good but there was little incentive for corporate treasury departments and CFOs to stick their neck out and try to print a deal in a market where Treasuries and credit spreads were moving in double digit increments intraday. We would expect to see some higher quality issuance next week if volatility subsides.

Investment grade credit reported its first weekly outflow of the year. Per data compiled by Wells Fargo, outflows for the week of March 9–15 were -3.8bln which brings the year-to-date total of positive inflows to +$62.1bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.