CAM Investment Grade Weekly Insights

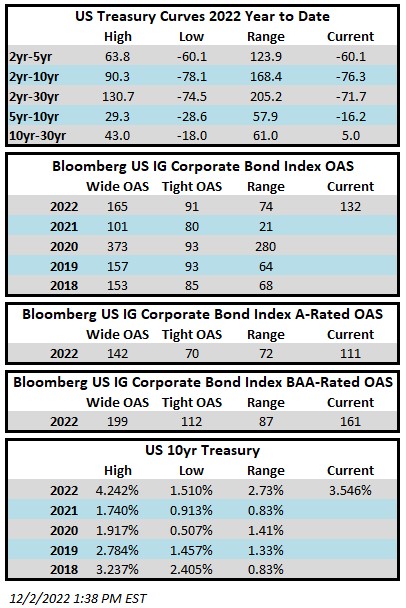

Investment grade credit spread performance was mixed throughout the week with spreads set to finish the week slightly wider. The Bloomberg US Corporate Bond Index closed at 132 on Thursday December 2 after having closed the week prior at 130. Treasuries continued to exhibit the same type of volatility that we have become accustomed to in recent weeks. The 10yr Treasury closed last week at 3.68% and it is trading at 3.55% as we go to print. The 10yr closed above 4% as recently as November 9, so this has been a significant move lower in yield over the course of only 15 trading days. Through this Thursday the Corporate Index had a YTD total return of -14.3% while the YTD S&P500 Index return was -13.2% and the Nasdaq Composite Index return was -26.0%.

There was plenty of economic data to parse this week. Things really started to ramp on Wednesday with a GDP print that morning that gave market participants some hope that inflation may be turning the corner and headed lower as the numbers showed slowing personal consumption and a core PCE figure that declined in 3Q relative to 2Q. Chairman Powell gave a speech later that day at the Brookings Institution that indicated that the Fed was set to moderate the pace of rate increases at its meeting on December 14. This sent stocks higher and Treasury yields lower. We were surprised by this price action as a 50 basis point hike in December should not have been seen by the market as new information. We believe that markets for risk assets are simply too eager for the Fed pivot when in fact chair Powell has been crystal clear that the Fed will not look to ease financial conditions through rate cuts until it is obvious that inflation is headed lower, closer to its longer term target. The Friday nonfarm payroll report was stronger than expected and showed that the labor market continued to be strong in November. Job gains and robust wage growth are not what the Fed was hoping to see and that data gives further credence to our belief that the Fed will not be in a hurry to cut its policy rate. An elevated policy rate for a longer time period is not problematic for bond investors as it affords an opportunity to generate more income for new money and incremental purchases but it does make this exercise more difficult when the market is so quick to see any bad news as good news, sending Treasury yields lower in the process.

The primary market had a busy week as issuers priced more than $22bln in new debt. Amazon led the way as it printed $8.25bln across 4 tranches. The 2022 issuance tally stands at $1,176bln which trails 2021’s pace by ~13%.

Investment grade credit reported an outflow for the week. Per data compiled by Wells Fargo, outflows for the week of November 24–30 were -$3.9bln which brings the year-to-date total to -$161.1bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.