CAM Investment Grade Weekly Insights

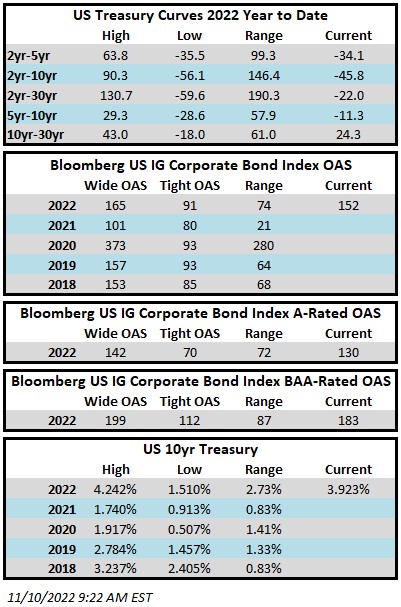

Investment grade credit spreads were unchanged on the week until the CPI print sent spreads tighter on Thursday morning. If this “risk-on” trade has legs, then spreads will finish the week in solidly positive territory. The credit market is closed this Friday in observance of Veteran’s Day but equities will remain open. The Bloomberg US Corporate Bond Index closed at 152 on Wednesday November 9 after having closed the week prior at 152. Treasury yields are sharply lower on the week with the bulk of that move occurring after CPI at 8:30am this morning. The 10yr Treasury closed last Friday evening at 4.16% and it is trading at 3.92% as we go to print. Through Wednesday the Corporate Index had a YTD total return of -19.5% while the YTD S&P500 Index return was -20.3% and the Nasdaq Composite Index return was -33.4%.

It was a lighter week for economic data relative to the last few weeks due in part to the fact that there were only 4 trading days. The big news of the week was CPI on Thursday, which was weak across the board. Recall that the last couple of CPI prints came in hotter than expectations. This is only one data point, so it cannot be called a trend, but it is a welcome relief to bond investors to see this number move in a favorable direction for a change. The next CPI release is on December 13 and the next FOMC decision is on December 14. There is also an employment report on December 2 as well as other economic data that will help guide the Fed. It will be interesting to see if the data allows the Fed to take its foot off the gas and back off from 75bps to 50bps at its December meeting.

The primary market was extremely active this week as 28 companies issued over $45bln of new debt across just three trading days. It is worth noting that the high yield primary market has thawed as well and it posted its busiest week since June. There are no new investment grade deals pending as we go to print on Thursday morning. The 2022 issuance tally stands at $1,125bln in volume which trails 2021’s pace by ~12%.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.