CAM Investment Grade Weekly Insights

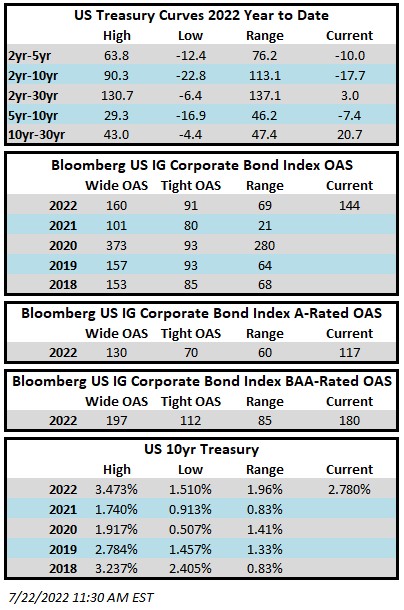

Investment grade credit performed well this week and it got better with each passing day. The Bloomberg US Corporate Bond Index closed at 144 on Thursday July 21 after having closed the week prior at 150. Spreads have now retraced 10% from the YTD wide OAS of 160 which was the closing spread level for the index on July 5. The market is strong as we go to print on Friday. The 10yr Treasury is yielding 2.78% after having closed the week prior at 2.92%. The 10yr Treasury rallied Friday morning as S&P Global’s July survey of purchasing managers showed business activity contracted for the first time in more than two years. Through Thursday the Corporate Index had a negative YTD total return of -12.80% while the YTD S&P500 Index return was -15.38% and the Nasdaq Composite Index return was -22.92%.

The primary market roared to life this week as borrowers, led by money center banks, brought over $45bln in new bonds. It was the busiest week of issuance since mid-April. This pace will assuredly slow next week as earnings season ramps up and the FOMC takes center stage on Wednesday with a rate decision. Street estimates are looking for $15-20bln in issuance primarily on Monday and Tuesday. There has been $782bln of new issuance YTD which trails 2021’s pace by 8% according to data compiled by Bloomberg.

Investment grade credit saw another outflow on the week but with declining velocity. Per data compiled by Wells Fargo, outflows for the week of July 14–20 were -$1.2bln which brings the year to-date total to -$127.1bln.