CAM Investment Grade Weekly Insights

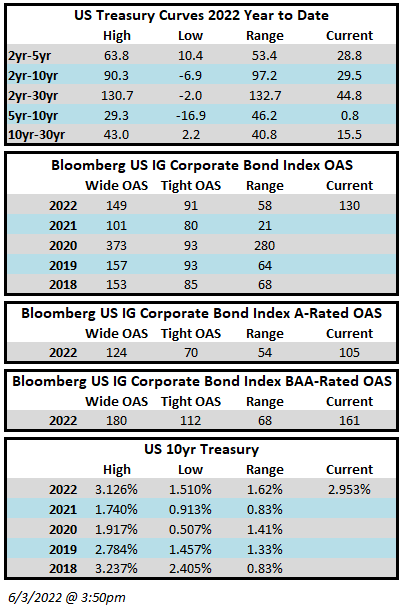

Credit spreads will finish the week meaningfully tighter for the second week in a row. The Bloomberg US Corporate Bond Index closed at 149 two weeks ago and 136 last Friday while the index closed this Thursday at an OAS of 130. Spreads have drifted wider during the trading day on Friday so we may close the week slightly wide of 130 but spreads will still finish the week better than where they started. The 10yr Treasury is yielding 2.95% as we go to print after having closed the week prior at 2.74%. IG corporate bonds posted their first monthly positive return of the year for May but the Corporate Index had a negative YTD total return of -11.79% through Thursday while the YTD S&P500 Index return was -12.11% and the Nasdaq Composite Index return was -21.3%.

Stocks traded lower on Friday on the back of payrolls data that was viewed as strong enough for the Fed to continue with its likely plan to raise Fed Funds by 50bps at its June meeting. The next big economic release to watch is CPI on June 10 with the FOMC rate decision to follow on June 15.

The new issue calendar was robust this week considering Memorial Day made for a shortened week. Issuers priced $29.9bln in new debt which was at the high end of estimates –financial institutions led the way with 75% of weekly volume. Next week should be another active one for issuance especially if credit spreads continue their positive trajectory.

Investment grade posted another modest outflow this week. Per data compiled by Wells Fargo, outflows for the week of May 26–June 1 were -$1.1bln which brings the year-to-date total to -$69.4bln.