CAM Investment Grade Weekly Insights

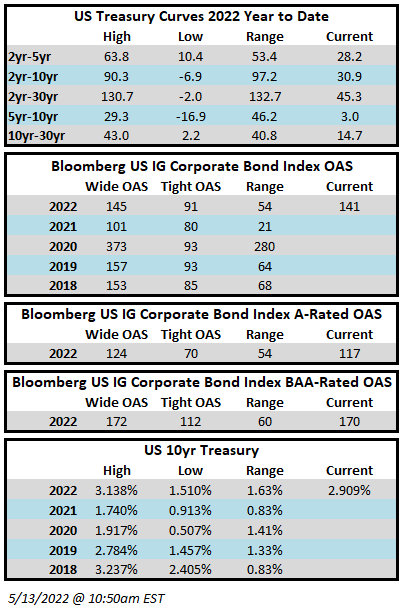

It was another volatile week for risk assets, especially equities. The OAS on the Bloomberg US Corporate Bond Index closed Thursday, the 12th of May at 141 after having closed the week prior at 134. The 10yr Treasury closed the previous week at 3.13% and it is trading at 2.91% as we go to print late Friday morning. The Investment Grade Corporate Index had a negative YTD total return of -12.90% through Thursday while the YTD S&P500 Index return was -17.11% and the Nasdaq Composite Index return was -27.32%.

Key economic data hit the tape this week with CPI on Wednesday morning and PPI on Thursday. CPI moderated from the previous month on a y/y basis but the headline number did surprise to the upside, as inflation did not slow as much as economists had predicted. This likely keeps the Fed on its tightening path at its June meeting where the market is looking for a 50bps increase in Fed Funds. PPI painted a picture of moderating inflation as the data showed that US producer prices increased more slowly in April than they did in March.

Volume in the investment grade primary market was less than investor expectations as $21.7bln in new debt was brought to market. There were multiple issuers that stood down during the week preferring to wait for calmer market conditions. Projections for next week are calling for $30bln of new issuance.

Per data compiled by Wells Fargo, flows for investment grade were negative on the week. Outflows for the week of May 5–11 were -$7.7bln which brings the year-to-date total to -$60.1bln. This was the largest weekly outflow from US IG in more than two years according to Wells.