CAM Investment Grade Weekly Insights

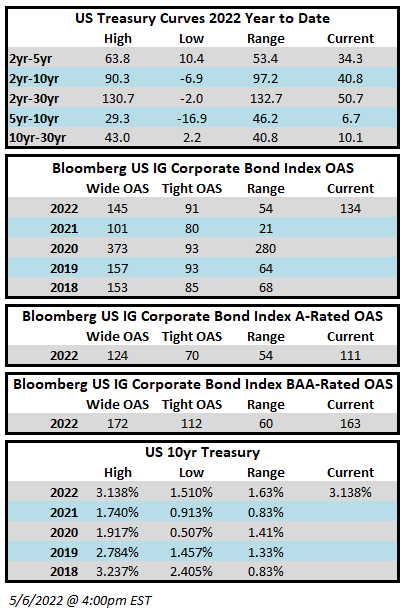

One word can aptly describe this week: volatile. The OAS on the Bloomberg US Corporate Bond Index closed Thursday, the 5th of May at 134 after having closed the week prior at 135. Although the spread on the index was slightly tighter the performance effect was offset by higher Treasury yields. The 10yr Treasury closed the previous week at 2.93% and it is trading at 3.14% as we go to print on Friday afternoon. The Investment Grade Corporate Index had a negative YTD total return of -13.39% through Thursday while the YTD S&P500 Index return was -12.59% and the Nasdaq Composite Index return was -21.27%.

The Fed delivered a 50bp hike of the Fed Funds Rate on Wednesday afternoon which was promptly followed by an aggressive move higher in equities and a rally in Treasuries. Credit spreads also moved tighter on the back of the FOMC. These moves were somewhat puzzling to us but market prognosticators were quick to explain them as a reaction to Chairman Powell’s reluctance to pound the table on a 75bp rate hike. Powell’s commentary was measured and led observers to believe that the Fed would not be hawkish at all costs and that the data would dictate their actions at subsequent meetings. The grab for risk dissipated quickly Thursday morning with a big reversal in risk as equities gave back all of Wednesday’s gains and then some. Friday too has been a relatively weak day for risk. Equities have bled lower while Treasuries have sold off on the back of a relatively unsurprising jobs report. Risk markets are not responding well to uncertainty and that has led to a roller coaster ride of volatility. Meanwhile, in the investment grade credit markets, yields sit at their highest levels in more than a decade and credit conditions remain strong –we feel that valuations are compelling at the moment.

Volume in the investment grade primary market managed to chug along and land right in the middle of the $20-25bln estimate with $22.6bln in new debt having been brought to market during the week. In our view this speaks to the resiliency of investment grade credit as it was pretty ugly out there yet borrowers were able to price new debt with reasonable concessions.

Per data compiled by Wells Fargo, flows for investment grade were negative on the week. Outflows for the week of April 28–May 4 were -$5.3bln which brings the year-to-date total to -$52.8bln.