2022 Q1 Investment Grade Quarterly

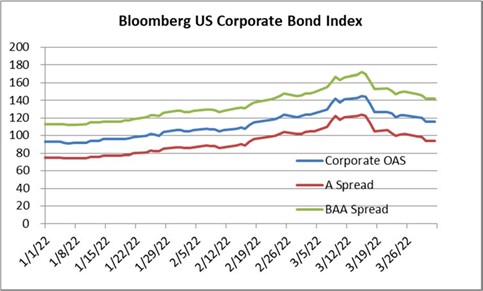

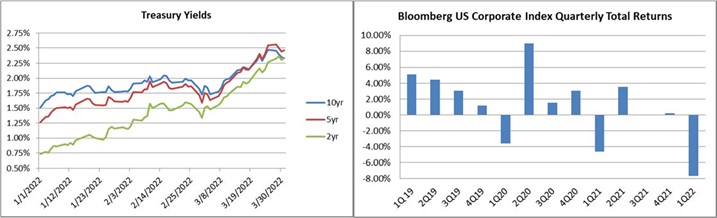

It was an extremely painful start to the year for credit markets as performance suffered due to wider spreads and higher interest rates. During the first quarter, the option adjusted spread (OAS) on the Bloomberg US Corporate Bond Index widened by 24 basis points to 116 after having opened the year at an OAS of 92. Interest rates finished the first quarter higher across the board. The 10yr Treasury opened the quarter at 1.51% and closed 83 basis points higher, at 2.34%. The move in the 5yr Treasury was even more dramatic as it rocketed higher by 120 basis points, from 1.26% to 2.46%. The 2yr Treasury saw the most movement of all with a 160 basis point increase from 0.73% to 2.33%. The extreme move higher in interest rates led to negative returns for fixed income products across the board. The Corporate Index posted a quarterly total return of ‐7.69%, its second worst quarterly return in history. The only quarter that was worse than this one was the 3rd quarter of 2008 in the midst of the Great Recession when the index posted a quarterly return of ‐7.80%. CAM’s net of fees 1st quarter total return was ‐6.75%.

You own bonds, now what?

Is now the time to panic? While we are certainly disappointed with short term negative performance we believe investors that are committed to the asset class will be rewarded over a longer time horizon. The thesis for owning investment grade credit as part of an overall diversified portfolio has not changed. Investors look to highly rated corporate bonds for diversification, income, and to decrease the volatility of their overall portfolio. While higher Treasury yields have led to negative performance for the past quarter it has also led to opportunity with investment grade yields that are now at their highest levels since the spring of 2019. Higher yields mean that newly issued corporate bonds will have larger coupons and more income generation.

For those who may view recent returns as a signal to either enter or exit certain asset classes, we would caution against such an attempt at market timing that currently might lead one to exit the investment grade corporate bond market. This is especially true when credit conditions are strong and the loss of value that occurred during the quarter was almost entirely driven by interest rates and not by the general creditworthiness of the investment grade universe. It is important to remember that bonds are a contractual obligation by the issuer – the bonds will continue to inch closer to maturity and pay coupons along the way. An investor who has seen a bond decrease in value will recapture some portion of that value over time in the form of coupon payments and an increase in principal value as the bond rolls down the yield curve toward maturity and its price converges toward par.

During the first quarter we experienced dramatically higher Treasury rates along with wider credit spreads. To put it into historical context, it was the second worst quarter for the Corporate Index since its inception in 1973. It is not easy to step in and buy here amid negative sentiment regarding the Fed and interest rates but we believe that is precisely what investors should be doing.

Credit Conditions

The investment grade credit markets were in very good health at the end of the first quarter. The secondary market has been liquid and the primary market was fully functioning, even during the volatile period for risk assets that coincided with early days of Russia’s invasion of Ukraine. Cash on investment grade non‐financial firms’ balance sheets was at all‐time highs at the end of 2020 and 2021.i Leverage ratios for IG‐rated issuers spiked during the early innings of the pandemic but leverage has since come down substantially and is now below pre‐pandemic levels.ii In 2020, due to the early severity of the pandemic, there were $186bln in downgrades from investment grade to high yield. That trend reversed sharply in 2021 with just $7bln in downgrades during the entire year while there were $35bln in upgrades from HY to IG. 2022 will go down in history as the “year of the upgrade” and there were $31bln in upgrades during the first quarter of 2022 alone.

J.P. Morgan has identified an additional $230bln of HY‐rated debt that could make its way to investment grade by the end of 2022. There is a high probability that 2022 will shatter records for the most upgrades during a calendar year. As far as the new issue market is concerned, the numbers have been very strong. March was the 4th busiest month on record for the primary market with $229.9bln in volume. There was $453.4bln of new issuance through the end of the first quarter, which was 4% ahead of the pace set in 2021.iii In aggregate, the investment grade universe is strongly positioned from the standpoint of credit worthiness and access to capital. We believe this is supportive of credit spreads.

Inflation, Interest Rates, the Fed: Impact on Credit

Inflation and interest rates are understandably a hot topic in our discussions with investors. Inflation is a problem, and headline PCE, which is the Fed’s preferred inflation gauge showed a year‐over‐year increase of

+6.4% for its February reading.iv Chairman Powell has responded with forceful rhetoric that the FOMC will do everything in its control to reign in price increases and the market has bought in. The consensus view is that inflation will slow throughout 2022. Along those same lines, it is widely anticipated that economic growth will slow throughout 2022 as well. At this point it seems likely that the Fed will raise its target rate by 50 basis points at its May and June meetings and then it could raise by 25 basis points in July, September, November and December. This is largely priced in at this point.v The risk with the Fed’s stance on inflation is that it could start to aggressively tighten monetary policy just as consumer spending begins to decline thus lighting the fire for a recession. History shows that it is very difficult for monetary policy to fight inflation and avoid a recession at the same time, thus the odds of a recession at some point over the next two years has increased substantially. Note that a recession simply means the economy has had two consecutive quarters of negative GDP growth –it is not a good thing, but a modest shallow recession does not necessarily mean economic disaster.

For credit, slower or negative growth likely means wider spreads but we would expect investment grade to outperform other risk assets in such a scenario. Investment grade balance sheet fundamentals are very strong and margins had been expanding until very recently and are near their peak. At some point, inflation will start to take a bite out of margins for some industries but in aggregate corporate credit is in very good health and well positioned to weather a storm. If the Fed manages to achieve its goal of a soft landing then that would be a scenario where risk assets perform reasonably well, but it could be accompanied by interest rates that inch higher from here, which would be a headwind for longer duration credit. An additional risk is that neither inflation nor economic growth decline in line with expectations throughout the rest of 2022; although we believe that this is the less likely of the two scenarios, it does remain a possibility that this path comes to fruition. If this happens then the Fed will have to become uber‐hawkish and may have no choice but to force the economy into recession to cool inflation.

What Does an Inverted Yield Curve Mean for Credit?

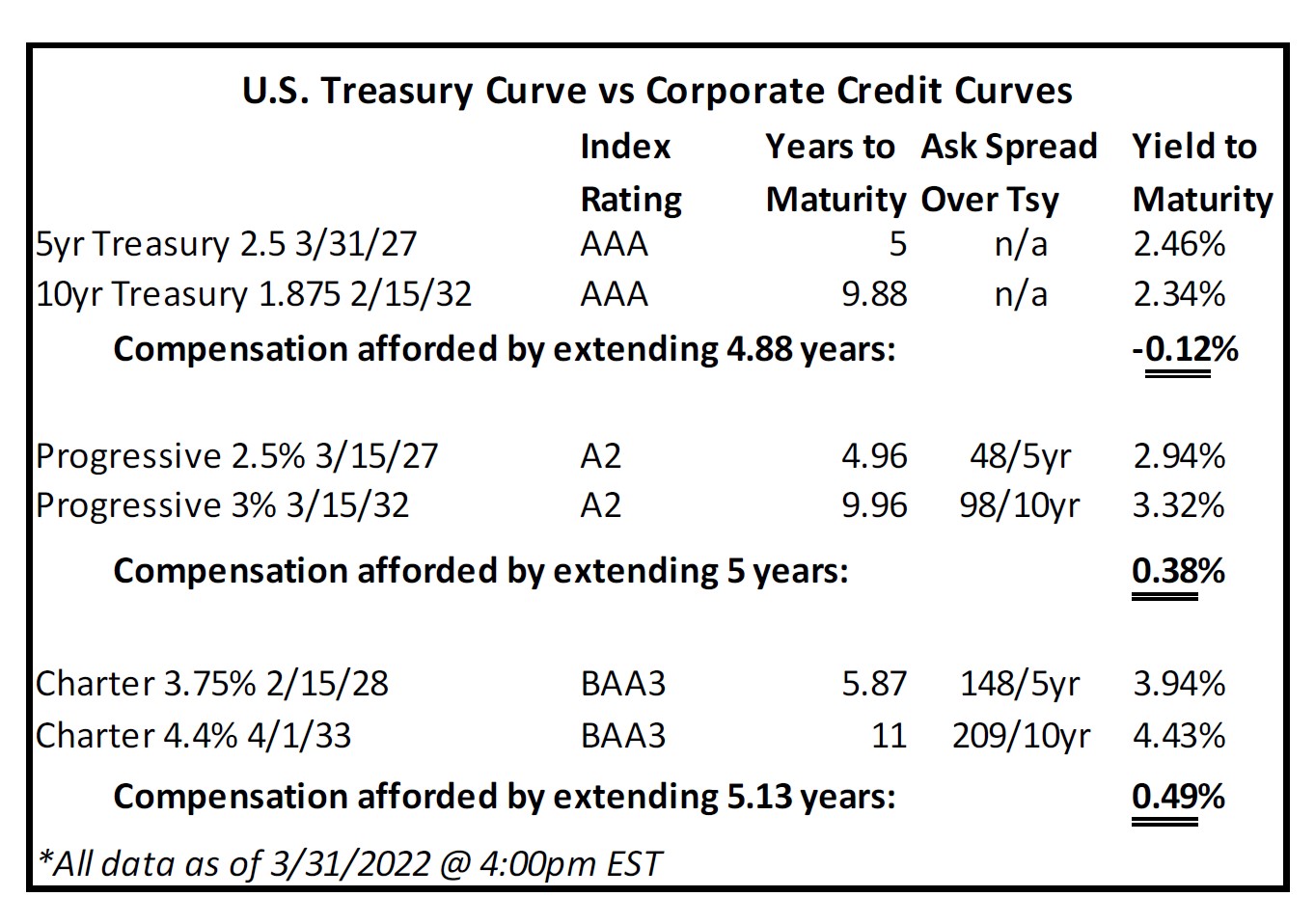

As a reminder, at CAM we position client portfolios in intermediate maturities. We typically purchase bonds that mature in 8‐10 years and then allow those bonds to roll down the yield curve, holding them for 3‐5 years before we sell and redeploy the proceeds into another bond investment. We do this because the 5/10 portion of both the Treasury curve and the corporate credit curve have been historically typically steep relative to the other portions of both of those curves. We prefer a steep 5/10 Treasury curve but at the end of the 1st quarter that curve was ‐12 basis points. Our strategy still works when there is an inverted Treasury curve because there is a corporate credit curve that trades on top of the Treasury curve that classically steepens when the Treasury curve flattens resulting in extra compensation for incremental duration. See the below chart that compares the Treasury curve at quarter end against the corporate credit curves of two bond issuers:

Note that the curve for Charter is steeper than Progressive. This is typical given that Charter is a lower quality credit than Progressive; the curve should be steeper for incremental credit risk. Curves are moving all the time and change by the day or even by the hour. To provide some recent historical context, the 5/10 Treasury curve was 80+ basis points just one year ago, which was its steepest level at any time in the previous 5 years –things can change quickly. Corporate curves also vary by industry with fast changing industries like technology typically having steeper curves than stable more predictable industries. It is the constant monitoring of these curves and the subsequent implementation of trades where an active manager adds value to the bond investment management process.

There are a variety of reasons that Treasury curves invert but the main reason comes down to Federal Reserve policy and its impact on the front end of the Treasury curve. Increasing the Federal Funds Rate has a disproportionate impact on Treasuries that mature in 5 years or less and especially those that mature in 2 years. Longer term Treasuries like the 10yr are much more levered to investor expectations for economic growth and longer term inflation expectations. We would note that this Treasury curve inversion is still very fresh and corporate credit curves have steepened moderately in the meantime. Over time, if Treasuries remain inverted, we expect to see more steeping of corporate credit curves.

Looking Ahead

It has been a tough start to the year but it is only April and there is still much to be written before we close the book on 2022. There are significant unknowns and risk factors that loom large as we navigate the rest of the year. The largest geopolitical uncertainty is the Russo‐Ukrainian War but China’s “zero‐Covid” policies are another risk that may not be fully appreciated by the markets as a slow‐down in China could have significant ramifications for global economic growth. Domestically, Federal Reserve policy is at the forefront and there are also mid‐term elections in the fall.

We believe higher Treasury yields and reasonable valuations for credit spreads along with healthy credit conditions for investment grade issuers have made the investment grade asset class as attractive as it has been in several years. The risk to our view is that Treasury yields could go even higher from here creating additional performance headwinds for credit.

We will be doing our best to navigate the credit markets in a successful manner the rest of this year and we appreciate the trust you have placed in us as a manager. Thank you for your business and please do not hesitate to contact us with any questions or comments.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein

i Goldman Sachs Global Investment Research, March 28 2022, “IG capital management: Deleveraging is the exception, not the rule”

ii Bloomberg, Factset, Goldman Sachs Global Investment Research

iii Bloomberg, March 31 2022, “IG ANALYSIS: Corebridge Debut Closes Out Record $230bln Month”

iv CNBC, April 1 2022, “The Fed’s preferred inflation gauge rose 5.4% in February, the highest since 1983”

v Bloomberg, March 14 2022, “Fed Traders Now Fully Pricing In Seven Standard Hikes for 2022”