CAM Investment Grade Weekly Insights

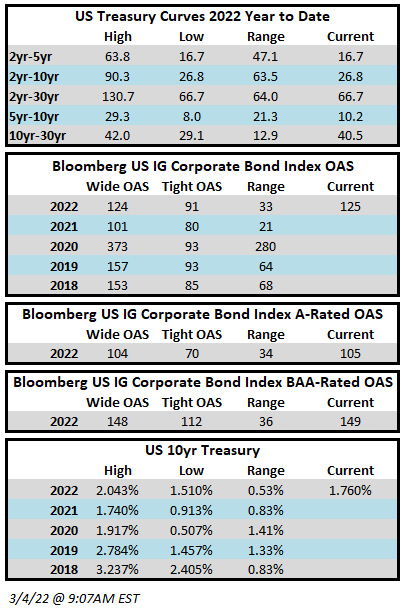

For the second consecutive week, spreads will finish a Thursday evening at the widest levels of the year. The tone of the market is also feeling heavy this Friday morning as we got to print amid geopolitical fallout from Europe. The prospect of a nuclear incident at a Ukrainian facility is not something the markets are taking lightly. On the domestic front, the Friday morning jobs report showed that U.S. hiring was strong in February with employment numbers handily beating consensus estimates along with an unemployment rate that edged lower, to 3.8%. This news likely keeps the Federal Reserve on track to begin its hiking cycle at its meeting later this month. The OAS on the Bloomberg US Corporate Bond Index closed at 125 on Thursday, March 3, after having closed the week prior at 121. The Investment Grade Corporate Index has posted a negative YTD total return of -5.8% through Thursday. The YTD S&P500 Index return was -8.4% and the Nasdaq Composite Index return was -13.5%.

The primary market was extremely active this week with 31 deals totaling over $53bln with at least one deal pending on Friday that will add to this total. This speaks to the resiliency of the investment grade credit market– even amid geopolitical uncertainty; the market remains open for business in a big way. Next week’s consensus forecast is calling for things to remain busy with predictions of more than $40bln in new issue. March is typically a seasonally busy month for issuance and it appears that 2022 is no exception.

Per data compiled by Wells Fargo, flows for investment grade were negative on the week. Flows for the week of February 24–March 2 were -$2.1bln which brings the year-to-date total to -$14.7bln.