CAM Investment Grade Weekly Insights

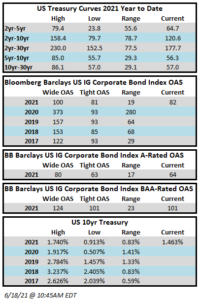

Spreads touched their narrowest levels of the year this week but are slightly wider off those tights as we go to print this Friday morning. The OAS on the Blomberg Barclays Corporate Index closed Thursday at 82, after closing the previous week at 84. Spreads have traded in a 5 basis point range over the course of the past four weeks. The FOMC took center stage with its meeting and commentary on Wednesday, and while most investors would agree that the Fed was more hawkish this week than it has been recently, it had little effect on Treasuries, with the biggest story being lower rates on the long end and flatter curves. The 10yr Treasury remains wrapped around 1.46%, nearly 30 basis points lower than the highs we saw at the end of March. Through Thursday, the Corporate Index had posted a year-to-date total return of -1.74% and an excess return over the same time period of +1.88%.

The amount of new issuance in recent weeks has been solid by historical standards but demand has been strong and frankly the market could use some more issuance to restore some two-way flow to its price action. $22bln of new debt priced during the week according to data compiled by Bloomberg and more than $757bln of new debt has been issued year-to-date.

Per data compiled by Wells Fargo, inflows into investment grade credit for the week of June 10–16 were +$10bln which brings the year-to-date total to +$203bln. According to Wells data compilation, this was the largest inflow into IG funds since September.