CAM High Yield Weekly Insights

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$0.4 billion and year to date flows stand at -$6.2 billion. New issuance for the week was $11.9 billion and year to date issuance is at $247.8 billion.

(Bloomberg) High Yield Market Highlights

- U.S. junk bonds are set to post gains for the eighth consecutive month after nearly $47 billion of sales have already made for the busiest May ever for new issuance.

- CCCs, the riskiest bracket in high-yield, are on track to record gains for the 14th straight month — the longest positive stretch since a 16-month streak ended September 1992, according to data compiled by Bloomberg

- The CCC tier is also poised to end May as the best-performing segment of the market for the sixth straight month with returns of 0.6%

- Barclays strategist Brad Rogoff wrote in note on Friday that spreads are close to recent tights and are well supported in the near term by the current technical and fundamental backdrop

- He cautioned, however, that in the longer term, the eventual withdrawal of extraordinary monetary and fiscal stimulus will be a potential risk for valuations

- Despite remaining on a pursuit for yield, investors still pulled money from U.S. high yield funds for the week. This was the fourth straight week of outflows from junk- bond retail funds

- The broader index posted gains again on Thursday and is expected to notch returns of 0.22% for the month, the eighth straight month of gains

- Yields closed flat at 4.11%, while spreads were at +302bps

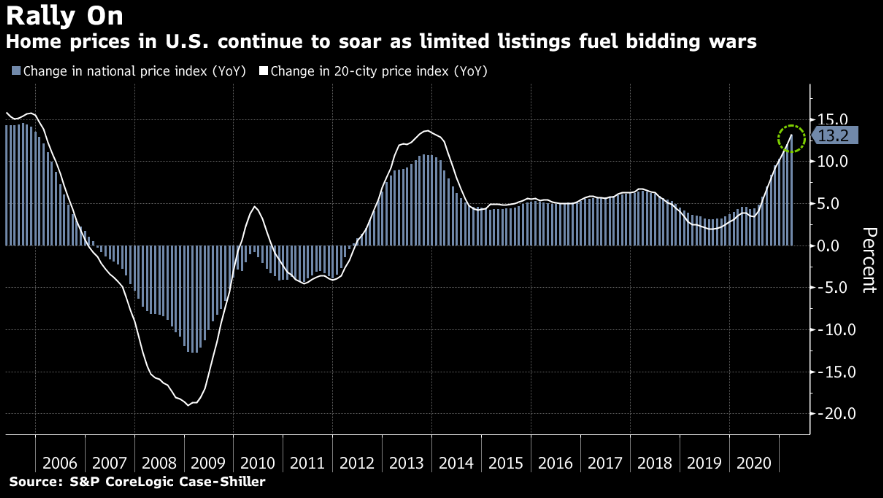

(Bloomberg) U.S. Home Prices Surge Most Since 2005, Fueled by Low Rates

- U.S. home prices surged the most since the end of 2005 as a shortage of properties to buy fueled bidding wars.

- Nationally, the S&P CoreLogic Case-Shiller index of property values climbed 13.2% in March from a year earlier, the biggest gain since December 2005. That came after a jump of 12% in February.

- Home prices in 20 U.S. cities gained 13.3%, meanwhile, beating the median estimate in a Bloomberg survey of economists. It was the biggest jump since December 2013.

- The real estate market has been surging for the past year as Americans seek properties in the suburbs, with low mortgage rates driving the rally. A dearth of available properties has also helped push up prices.

- “These data are consistent with the hypothesis that Covid-19 has encouraged potential buyers to move from urban apartments to suburban homes,” said Craig J. Lazzara, global head of index investment strategy at S&P Dow Jones Indices. “This demand may represent buyers who accelerated purchases that would have happened anyway over the next several years.”

- Phoenix (20%), San Diego (19.1%) and Seattle (18.3%) posted the biggest increases among the 20 cities tracked by Case-Shiller.