CAM Investment Grade Weekly Insights

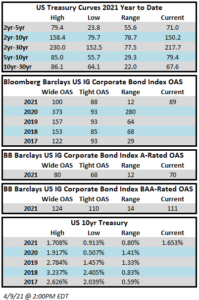

Spreads exhibited little movement this week and the spread on the index looks likely to finish unchanged after it is all said and done. The OAS on the Blomberg Barclays Corporate Index closed Thursday at 89 after closing the week prior at 89. Spreads are very near their year-to-date tights across the board. Treasury yields moved lower throughout the week before drifting higher on Friday. As we go to print on Friday, the 10yr Treasury is almost 10 basis points lower from quarter end when it closed at 1.74%. Through Thursday, the corporate index had posted a year-to-date total return of -3.77% and an excess return over the same time period of +1.07%.

Primary market issuance was subdued this week, which is customary in the days following quarter end. Borrowers brought just $17.6bln of new debt. According to data compiled by Bloomberg, $455bln of new debt has been issued year-to-date, with a pace of -22% relative to last year.

Per data compiled by Wells Fargo, inflows into investment grade credit for the week of April 1-7 were +$5.3bln which brings the year-to-date total to +$112.8bln.