CAM High Yield Weekly Insights

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$0.1 billion and year to date flows stand at $1.8 billion. New issuance for the week was $3.0 billion and year to date issuance is at $75.4 billion.

(Bloomberg) High Yield Market Highlights

- The U.S. junk bond market is wrapping up the slowest week for issuance this year with just $3 billion of debt sold so far, and no deals as yet slated to price Friday. Average yields, meanwhile, have bounced off all-time lows reached earlier this week.

- As new issuance slowed, investors piled billions of dollars into offerings that did come to market even as high-yield funds saw an outflow this week

- February issuance volume is running at almost $25b, about $5b away from the total amount sold in the same month last year, according to data compiled by Bloomberg

- CCCs, the riskiest junk bonds, have accounted for 25% of bond sales this month. Issuers have ranged from energy firms to covid-hit borrowers from the travel, leisure and entertainment sectors

- Average junk bond yields rose 3bps to 3.99% Thursday, but are still just 10bps off the record low set earlier this week

- The broader index posted a loss of 0.05% on Thursday, the second consecutive session of negative returns, and the biggest one-day loss in three weeks

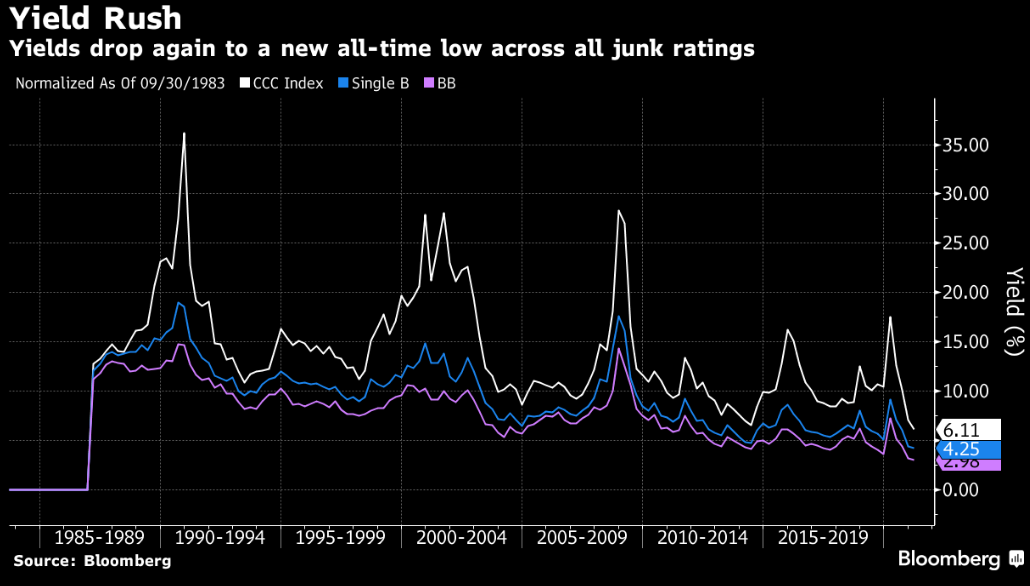

(Bloomberg) BB Junk-Bond Yields Drop Below 3% for the First Time Ever

- The average yield on U.S. junk bonds in the Double-B tier dropped below 3% for the first time ever on Tuesday as investors continue to pile into an asset class historically known for its high yields.

- The average yield on BB debt, the safest of junk bonds, fell 7bps to a record low of 2.98%, according to Bloomberg Barclays index data

- The measure for the broader U.S. Corporate High-Yield index dipped to 3.89%, down 7bps in the biggest one-day decline in about seven weeks, the data show

- CCC yields also fell to a new low of 6.11% amid calls from some credit strategists to selectively buy the riskiest of junk bonds to boost returns

- There is “no reason to be bearish” and cash levels are down to just 3.5%, an eight-year low, Bank of America wrote in the report based on a survey of global fund managers

- More borrowers are expected to sell new debt to take advantage of cheap borrowing costs and strong demand from investors

- CCC debt has gained 1.19% in February, and 2.69% since the start of the year, beating all other rating buckets in the junk bond market

- The broad junk index has gained 1.02% month-to-date and 1.36% year-to-date

- The rally may continue with oil closing at a 13-month high near $60as a winter storm halts a third of U.S. crude output

(Wall Street Journal) Saudis Plan to Reverse Oil Cuts as Prices Rise

- Saudi Arabia plans to increase its oil output in the coming months, reversing a recent big production cut, advisers to the kingdom said, a sign of growing confidence over an oil-price recovery.

- The world’s largest oil exporter surprised oil markets last month when it said it would unilaterally slash 1 million barrels a day of crude production in February and March in an effort to raise prices.

- But the kingdom plans to make public a reversal of those cuts when a coalition of oil producers meet next month, the advisers said, in light of the recent recovery in prices. The output rise won’t kick in until April, given the Saudis already have committed to stick to cuts through March.

- The advisers cautioned the plans still could be reversed if circumstances change, and the Saudis’ intention hasn’t yet been communicated to the Organization of the Petroleum Exporting Countries, the people and OPEC delegates said.

- “We are in a much better place than we were a year ago, but I must warn, once again, against complacency,” Prince Abdulaziz bin Salman, the Saudi energy minister, said at a conference on Wednesday. “The uncertainty is very high, and we have to be extremely cautious.”

- “A Saudi increase in production. . .makes perfect sense given the tightness that is starting to emerge in the market,” said Ole Hansen, head of commodity strategy at London-based Saxo Bank. “The market will probably take it quite well.”

- The planned Saudi move to restore supplies isn’t expected to immediately spark large output increases from other big producers, analysts said, given the kingdom is acknowledged to have carried the biggest burden in reducing production.

- However, analysts do expect compliance with output curbs among producers to be increasingly loose as the recovery gains momentum.