Q4 2020 INVESTMENT GRADE COMMENTARY

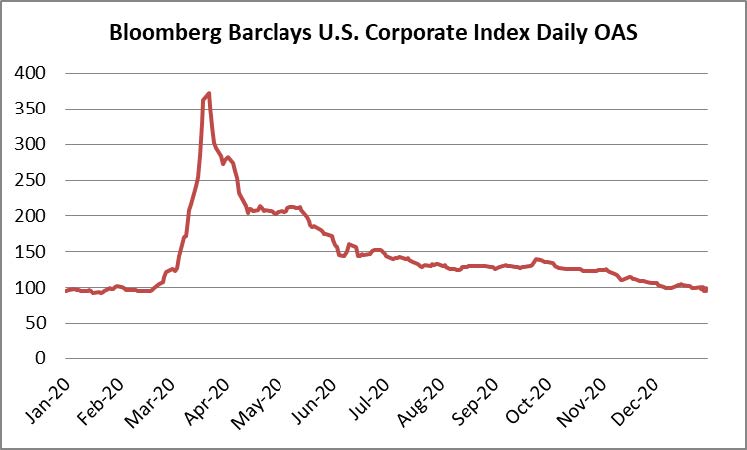

Investment grade corporate bonds rode a roller coaster in 2020 so it should be no surprise that, after peaks and valleys, spreads finished the year nearly right where they started. The option adjusted spread (OAS) on the Bloomberg Barclays US Corporate Bond Index opened the year at 93, but soon thereafter, pandemic induced uncertainty gave way to panic stricken selling, sending the OAS on the index all the way out to 373 by the third week of March– its widest level since 2009, during the depths of The Great Recession. On March 23, the Federal Reserve announced extensive measures to support the economy and liquidity within the bond market and spreads reacted in kind, grinding tighter. There were pockets of volatility along the way, but absent a few hiccups it has been a one-way trade of tighter spreads since the end of March, with the OAS on the index finishing 2020 at 96; a mere 3 basis points wider on the year.

Lower Treasuries were the biggest driver of performance for credit during the year. The 10yr Treasury opened 2020 at 1.92% and closed as low as 0.51% at the beginning of August before finishing the year at 0.91%. The Corporate Index posted a total return of +3.05% during the fourth quarter and a full year total return of +9.89% for 2020. This compares to CAM’s gross quarterly total return of +1.86% and full year gross return of +8.73% for 2020.

2020 Investment Grade Returns – What Worked & What Didn’t?

The big winner in 2020 was duration, with lower rates leading to higher prices for bonds, all else being equal. Although the Corporate Index was up almost 10% for the year, excess returns, which measure the performance of corporate credit excluding the benefit of lower Treasury rates, were modest. The sectors that posted the best excess returns in 2020 were Basic Industry, Technology and Financials. At the sector level, Energy was the worst performer with an excess return of -5.97%, with particular underperformance for Independent Energy, which as an industry posted a 2020 excess return of -11.27%. Also at the industry level, Airlines predictably underperformed, with a 2020 excess return of -8.91%.

What to Expect in 2021?

With equity indices at all-time highs and yields on corporate bonds at all-time lows, where do we go from here? In our opinion, the theme for 2021 should be one of guarded optimism. Vaccinations have been approved and are being administered and there are more in the pipeline. Healthcare providers have become more adept at managing care and therapeutic treatments are more readily available. The policy response from the Federal Reserve has been strong and the Fed stands ready and willing to lend more support if it is needed.

As far as investment grade bonds are concerned, we expect a transition to occur as we enter 2021 and that the script will flip from 2020’s broad based risk rally to more of a credit pickers environment in 2021, where bottom up fundamentals become more important and investment managers must carefully evaluate the risks and potential rewards for each individual position within a portfolio. Credit spreads and Treasuries are beginning the year at levels that do not set-up well for the type of returns we experienced in 2019 and 2020, when the corporate index tallied gains of +14.54% and +9.89%, respectively. But outsize returns over short time horizons are not the best case for owning investment grade corporate bonds. Advisors and clients that we talk to favor investment grade corporate bonds for their low volatility, the diversification benefit they provide to an overall portfolio or their ability to generate income in a safer manner than relatively more risky asset classes. These traits are magnified over longer time horizons and thus the asset class lends itself to being more strategic in nature as an allocation within a portfolio.

As we turn the page to the New Year we see several factors that could lend support to credit spreads in 2021.

- Lower New Issue Supply in 2021 – Investment grade borrowers issued nearly $1.75 trillion of new debt in 2020 which shattered the previous record by 58%i. Bond dealers are expecting as much as $1.3 trillion of issuance in 2021, but most estimates are falling around $1.1 trillion. Even at the high end of the estimated range, the expectation is for substantially less supply. Demand overwhelmed supply the last several months of 2020 as evident by oversubscribed order books and narrow new issue concessions (the extra compensation/yield that issuers use to compensate investors in order to entice them to buy their new bonds versus their existing bonds). An environment with excess investor demand is supportive of spreads in the secondary market.

- It’s Just Math: Global Edition – Even though US nominal yields are low, they are still meaningfully higher than foreign investors can find elsewhere. There was $17.8 trillion in negative yielding debt around the globe at the end of 2020ii. The following developed countries had negative 10yr sovereign bonds at conclusion of the year: France, Germany, Netherlands, and Switzerland. Sweden had a 10yr yield at year end of 0.009% and Japan was at 0.013%. Simply put, foreign investors have very few options, and many, such as pensions and insurance companies, must generate a return by investing in high quality assets. The U.S. investment grade credit market is the largest, deepest and most liquid bond market in the world by an order of magnitude. There is some nuance at play here in that these investors must account for hedging costs and that can cause demand to ebb and flow at times but they will remain an important fixture in our market for the foreseeable future and their demand is a technical tailwind for spreads.

- Improving Economy – We expect that the economy will see solid improvement in 2021 but that it will be highly industry/company specific. Some industries are still significantly impaired, and some will be impaired permanently. There will be some opportunities in industries that are facing temporary headwinds. As earnings recover it will be important for an investment manager to differentiate among those companies who will use the earnings recovery for balance sheet repair versus those who may choose to engage in M&A, shareholder rewards or adopt a more aggressive financial policy by operating with higher leverage.

- Yields are Low, but Curves are Steep – Of particular importance to an intermediate manager like CAM, is the steepening that we have seen in the 5/10 Treasury curve. If you are a repeat reader, you know that we are interest rate agnostic and that we typically buy 8-10yr bonds and allow those bonds to roll down the curve to 4-5yrs before we sell and redeploy the proceeds back out the curve. The 5/10 curve ended the year at 55 basis points which was near its highest levels of the year, after averaging less than 35 basis points during 2020. For context, the 5/10 curve closed above 30 on only one day for the entire two year period from the beginning of 2018 to the end of 2019. A steeper curve allows for more attractive extension trades and offers better roll-down potential for current holdings. It is a mechanism that allows a manager to generate a positive total return despite a low rate environment.

Like any investment process, there are risks to our view as well.

- Inflation – We think that 2021 will be a year that is rife with inflation scares and that it could lead to volatility in Treasuries and corporate bond valuations. In fact, the first trading day of 2021 generated a headline as the 10yr breakeven rate surpassed 2% for the first time in over 2 yearsiii. The breakeven rate implies what market participants expect inflation to be in the next 10 years, on averageiv. We do think that we will see inflation in 2021 but that it will be isolated pockets of higher prices confined to specific sets of circumstances. We have already seen this happen for some goods, such as lumber and building materials and we expect to see the same when demand increases for items like airline travel and indoor dining. The official definition of inflation, however, is a broad based and sustainable increase in prices. The U.S. consumer has been resilient, but consumer spending has been biased toward upper middle class and high income households who have been less affected financially by the pandemic. The overall unemployment rate remains high at 6.7% and it is significantly worse for those workers with lower educational attainment. The unemployment rate for those 25 years and over with less than a high school diploma is 9% and those with a high school diploma and no college is 7.7% while those with a bachelor’s degree or higher have a 4.2% unemployment ratev. In our view, without a more complete recovery across the entirety of the labor market, it is unlikely that the economy will experience significant inflation.

- Slower Economic Recovery – Risk assets are at all-time highs and it appears that good news surrounding vaccines and economic recovery is fully priced as far as valuations are concerned. This leaves little room for error if expected outcomes do not meet lofty expectations. Domestically, the initial vaccine rollout fell short of its goal, having administered only 4.2 million doses by year end versus a target of 20 millionvi. The scientific community is also concerned with new variants of Covid-19, with the UK strain having recently been identified in the U.S.vii and some epidemiologists’ are questioning vaccine efficacy on a newly identified strain found in South Africaviii. We are also concerned about the lingering economic impact that the pandemic may have on small business. While small business optimism has rebounded smartly from the depths of the crisis, many of these firms do not have the financial wherewithal to survive a more prolonged recoveryix.

CAM’s Portfolio Positioning

Our investment strategy has remained consistent in its approach, with a focus on bottom-up fundamentals. It was a challenging year that required constant adaptation to market conditions and the investable opportunity-set at any given point in time. In March and April, we were extremely involved in the new issue market, as concessions rose and high quality borrowers tapped the market to shore up their balance sheets. We were also able to invest in shorter maturities as forced selling caused dislocation across corporate credit curves creating opportunities to buy shorter bonds at yields that were equal or greater to longer maturities. As market conditions normalized throughout the second half the year, we took a more balanced approach between the new issue market and the secondary market. Our focus remained biased toward higher quality credit and sectors of the market that were less levered to the re-opening of the economy and those industries that benefited from more work and leisure time spent at home. As we head into the first quarter of 2021 we continue to favor companies with strong balance sheets and stable credit metrics as the entire market has continued to rally into the New Year. As spreads and yields compress, the incremental compensation afforded from taking additional credit risk has skewed risk-reward to the downside. The “buy the dip” trade has played out in our view and we are scrutinizing the capital allocation strategies of each of the companies in our portfolio. 2021 could be the year were there is a more clear bifurcation between those companies who will exit the pandemic stronger and those who will languish because the business is saddled with too much leverage and unable to effectively compete in the marketplace. As always, preservation of capital will continue to be at the forefront of our decision process.

We wish you a happy, healthy and prosperous New Year. Thank you for your business and continued interest.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

i Bloomberg, December 15, 2020 “Freeze to Frenzy, Corporate Bonds Bounce Back”

ii Bloomberg Barclays Global Aggregate Negative Yielding Debt Market Value USD

iii Bloomberg News, January 4, 2021”Treasuries Inflation Gauge Exceeds 2% for First Time Since 2018”

iv Federal Reserve Bank of St. Louis (T10YIE)

v U.S. Bureau of Labor Statistics, December 4, 2020 “Employment status of the civilian population 25 years and over by educational attainment”

vi The Hill, January 4, 2021, “Operation Warp Speed chief adviser admits to ‘lag’ in vaccinations”

vii The Wall Street Journal, January 4, 2021, “Highly Contagious Covid-19 Strain Has Been Found in New York State, Gov. Cuomo Says”

viii Bloomberg, January 4, 2021, “South African Covid Strain Raises Growing Alarm in the U.K.”

ix NFIB, December 8, 2020, “NFIB Small Business Economic Trends – November”