CAM High Yield Weekly Insights

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$4.8 billion and year to date flows stand at $43.7 billion. New issuance for the week was $11.2 billion and year to date issuance is at $330.1 billion.

(Bloomberg) High Yield Market Highlights

- U.S. junk bonds are headed for the biggest weekly loss since April amid fund outflows, equity volatility and concerns about the economic outlook. Most new issues have been well received by investors, but borrowers may take a step back until more stability returns.

- Investors pulled over $4 billion from junk-bond funds during the week, the 10th biggest withdrawal on record

- Spreads widened another 14bps Thursday. They’ve jumped 43bps since last Friday to 533bps more than Treasuries, the highest level since July 17, according to the data

- Yields have risen 15bps to a 10-week high of 5.98%. They’ve been under pressure for six straight days, the longest losing streak since March

- The index has lost 1.45% this week, the worst since April. Energy has lost 2.93%, the most since March

- The primary market has still managed to absorb more than $11 billion of new issue supply this week,

- The number of bonds trading above call prices has fallen to $37.3b outstanding from $56.8b the previous week, which could have a knock-on effect on potential refinancings

- September volume has reached more than $44 billion to make it the fourth busiest month on record, the data show

(Bloomberg) U.S. Junk Bonds Set Sales Record Amid Yield Hunt

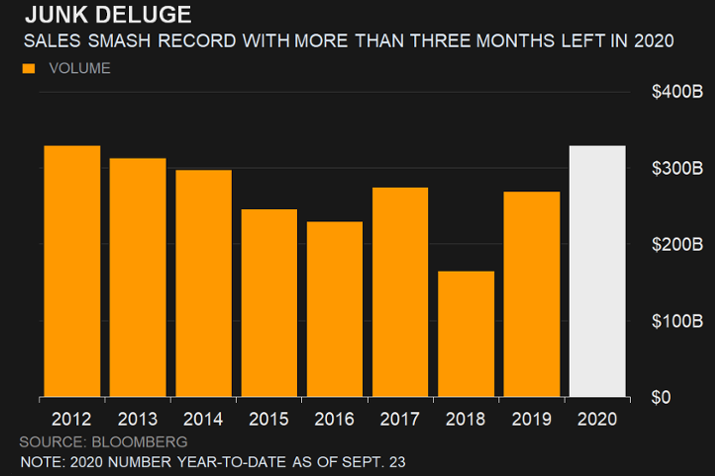

- U.S. high-yield bond sales reached an annual record of $329.8 billion Wednesday as companies reap the benefits of the Federal Reserve’s liquidity-boosting policies and investors grasp for yield.

- The crush of debt offerings accelerated in April after the U.S. central bank began purchasing some high-yield bonds as part of its efforts to support the corporate credit markets.

- Since then, issuance has eclipsed the prior annual sales record of $329.6 billion set in 2012, according to data compiled by Bloomberg.

- Companies staring at sharp, pandemic-induced revenue declines were emboldened to borrow billions of dollars to help ride out the pandemic. Some of the most virus-battered borrowers, including airlines, hotels and even cruise operators, were able to tap investors for financing, sometimes paying double-digit coupons.

- Now, junk-rated issuers have tilted away from securing lifelines and are instead looking to lock in lower interest rates and push out maturities on existing debt loads. The shift, coupled with support from the Fed, has forced investors to accept diminishing yields.

- The junk market’s record year follows the U.S. investment grade bond market, which reached a new annual issuance high in mid-August. Europe’s high-yield bond sales surged in July, the busiest for that month since 2009.