CAM Investment Grade Weekly Insights

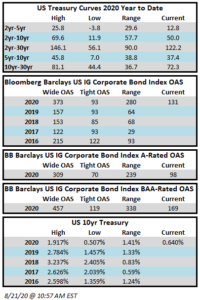

Spreads are wider on the week. The Bloomberg Barclays US Corporate Index closed on Thursday August 20 at 131 after closing the week of August 10-14 at 128. The market has the feel of a quiet summer Friday as we go to print this morning. Through Thursday, the corporate index has posted a year-to-date total return of +7.34%. Treasury yields are lower this week after having trended higher each of the last two.

The high grade primary market was reasonably active again this week, especially for what is typically a seasonally slow time as issuers printed nearly $36bln in new debt. Of note, the August all-time issuance record has already been broken with nearly $120bln in issuance month-to-date, according to data compiled by Bloomberg. Consensus estimates are calling for ~$20bln in issuance next week.

According to data compiled by Wells Fargo, inflows for the week of August 13-19 were +$8.0bln which brings the year-to-date total to +$136bln. This was the 20th consecutive week of inflows into the investment grade corporate bond market.