CAM Investment Grade Weekly Insights

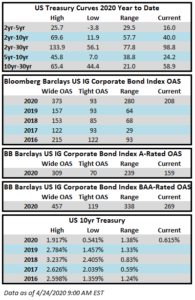

The streak of tighter spreads for the past four weeks is in jeopardy. The Bloomberg Barclays US Corporate Index closed Thursday at an OAS of 208 after closing the prior week at 206. The tone is mixed as we go to print on Friday morning so unless something changes throughout the day it looks unlikely that the market will close inside of 206, bringing the streak to an end. Spreads have come a long way in the past month and it was a month ago today when the market closed at its widest level of the year with at 373 OAS on March 23. Through Thursday, the index total return for the year was +1.41%.

It was a volatile week in the markets characterized by a brutal selloff in WTI crude futures which went negative for the first time. Stocks were lower and spreads were wider on Monday and Tuesday but both reclaimed some ground on Wednesday and Thursday. Economic data, too, was exceptionally poor although this was largely expected and already priced into risk assets to a large degree. There is much to digest over the course of the next two weeks as the volume of companies reporting earnings will increase substantially. The question is; how bad will it get? This type of environment highlights the importance of both active management and bottom up research.

The primary market was busy yet again, even amidst earnings blackouts, which prohibit most companies from issuing new debt. Issuers brought $35.5bln in new debt through Thursday and there are several benchmark deals pending in the market on Friday which should push the weekly total to around $38bln. Issuance should slow for the next several weeks but we are still likely to see solid activity as companies continue to take advantage of low borrowing costs and inflows into the credit markets have provided plenty of investor demand. According to data compiled by Wells Fargo, inflows for the week of April 16-22 were +$3bln which brings the year-to-date total to -$92.3bln.