2020 Q1 Investment Grade Commentary

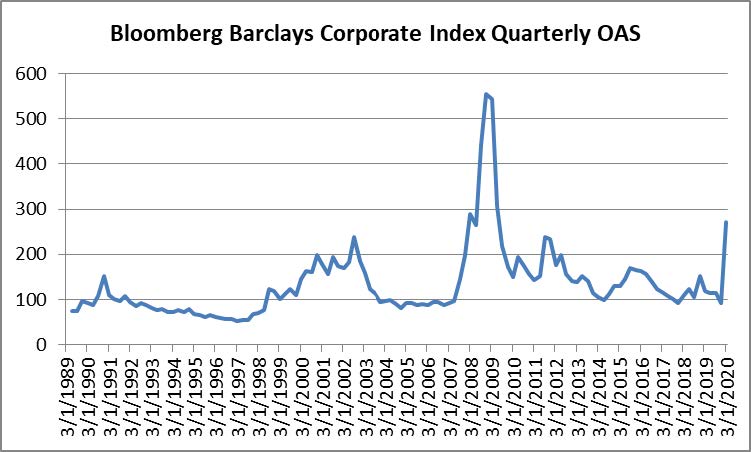

Investment grade credit just endured one of the most volatile quarters in the history of its existence. Most market participants would agree that only the 2007-2008 global financial crisis can compare to what we have experienced the past month. Spreads were humming along for the first two months of the year before they spiked to levels that had only been seen once since the 1988 inception of the Bloomberg Barclays US Corporate Index.

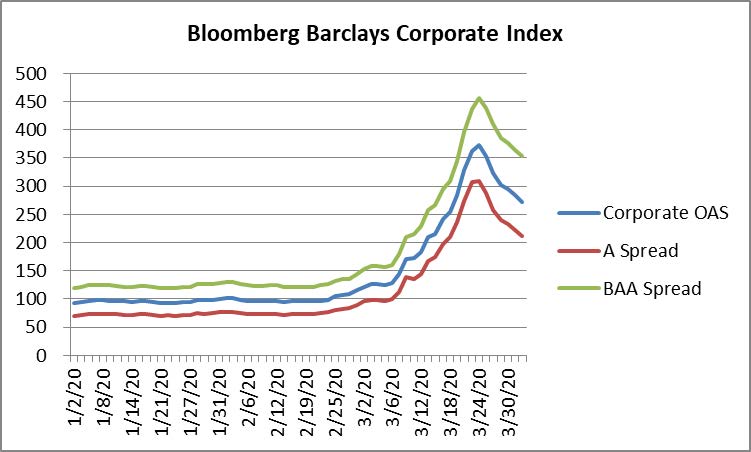

At its nadir on March 20, the index was down -10.58% year-to-date. For investment grade, in our view, this violent sell off was much less about credit than it was about liquidity and fund flows. Investors pulled a record amount of funds from bond markets over a two week period and the unbridled panic selling coupled with the proliferation of the liquidation of exchange traded funds led to a liquidity vacuumi. As a result there was very little in the way of orderly price discovery. It was perhaps, in our estimation, one of the worst times to sell in the history of the investment grade credit market and this was reflected in the prices of bonds that did sell during this time periodii. The tone in the market shifted substantially on Monday, March 23 as it seemed investors came to terms with the fact that yes, the challenges in front of us are enormous, and the economic data could be quite bad for some time, but humanity will persevere and the world will not end. The shift in tone led to a reversal in risk appetite and the Bloomberg Barclays US Corporate Index finished the quarter with a total return -3.63% while the S&P500 finished with a total return of -19.60%. This compares to CAM’s gross total return of -3.09%. We believe that policy actions by the Federal Reserve, and to a lesser extent, the passage of stimulus by lawmakers did much to restore confidence within the credit markets.

While we are not satisfied that the value of our portfolio declined during the quarter we feel that we are well positioned to weather an economic downturn. The portfolio has a significant structural underweight in BAA-rated credit and it is also underweight the energy sector and zero weight the leisure, gaming, lodging and restaurant industries, which have been particularly hard hit by the cessation of economic activity.

Overwhelming Supply and Outsize Compensation

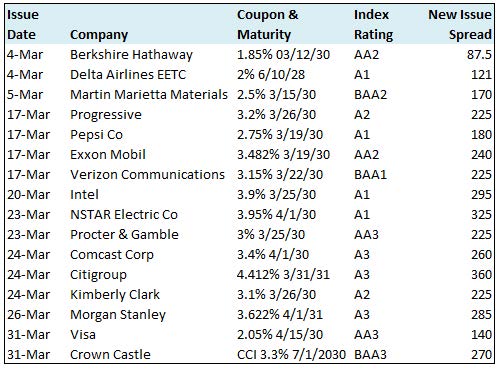

We frequently speak of new issuance in our commentaries because it is the lifeblood of the corporate credit markets and one of the fundamental ways that fixed income investors acquire new investment opportunities. At CAM, during the invest-up process we will typically populate a new account with 20-30% new issuance as long as concessions from borrowers are attractive and we will also use these opportunities to add exposure for fully invested accounts that have cash available for reinvestment. There are companies constantly borrowing in the corporate bond market to fund capital allocation plans such as property, plant and equipment, liquidity or even shareholder returns. The month of March was one of the most interesting time periods for issuance that we have ever seen in our market and it was really a dichotomy of two halves. In first half of the month the primary market battled volatile treasury rates and record outflows from investment grade funds. According to data compiled by Bloomberg, through Friday, March 13, issuance stood at $37 billion. This was modestly lighter than street expectations to that point as volatility in both spreads and rates had kept issuers at bay. This all changed on March 17, as a myriad of high quality companies elected to take advantage of historically low Treasury rates and push through with issuance even despite historically high credit spreads. The new issue concessions offered during the two week period that would follow were the most attractive that the market has seen in over a decade with many concessions approaching 50-100bps relative to secondary offerings. As a colleague put it, the primary market was being dominated by borrowers who don’t need credit. What we saw were dozens of companies with extremely strong balance sheets borrowing to bolster liquidity in the face of economic uncertainty and they were willing to pay up to do so, but even if spreads where high, the borrowing costs that they were paying were still quite low when viewed through a historical lens. By the time the month had ended, March had rocketed to the top of the leaderboard for the busiest month in the history of the primary market with $259.2 billion in new supply. This was 46% higher than the previous record of $177.7 billioniii. Below you will find a table of all of the primary deals that CAM purchased for client accounts during the month of March.

As we turn the page to April we are still finding attractive concessions, but they are not what they were two weeks ago. We expect that volatility in credit spreads will come and go as the world battles through the current crisis but it is entirely possible that we may go a decade or more before we see primary market opportunities like the ones we saw the third and fourth week of March. This is why we constantly preach the need to have a long term strategic view for this asset class. A permanent allocation of capital is ideal in order to take advantage of opportunities like these when they do arise.

Fallen Angels and the Growth of BAA-rated Credit

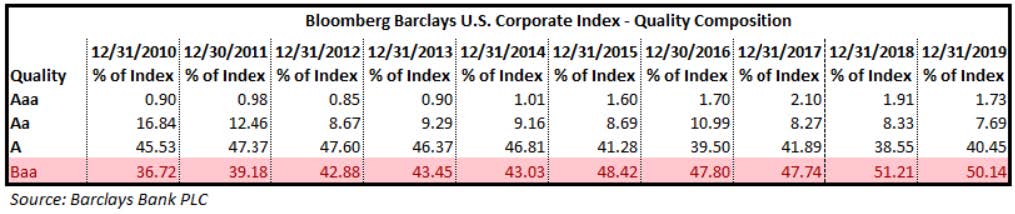

One of the favorite topics of the financial press is back at the forefront, and for good reason, as it is a legitimate concern that could have a significant impact on the credit markets. In our discussions with investors we tend to find that there is fear surrounding fallen angels as it relates to the investment grade credit market but this is really a high yield problem, and it comes down to the size, depth and liquidity of the high yield universe relative to the investment grade universe. The face value of the investment grade universe is $6.7 trillion while the high yield universe is just over $1.2 trillion. The investment grade BAA-rated universe is over $3.4 trillion, almost three times the size of the

entire high yield universeiv. According to research by J.P. Morgan, they expect a record $215 billion in high grade debt could fall to high yield in 2020, driven predominantly by the energy and automotive sectorsv. This is not a problem for investment grade in general as these bonds are simply leaving the investment grade universe. It could be a problem for the bondholders of those companies who are downgraded and for high yield investors who are beholden to an index and must purchase the downgraded bonds of investment grade companies whether they like them or not.

As far as CAM’s positioning, we limit our exposure to BAA-rated credit at 30%, while the investment grade universe is more than 50%. Although we are significantly underweight BAA-rated credit we do allow the portfolio to hold split rated credits. Most often this is because it is a credit with just one or two investment grade ratings that is on its way to becoming fully investment grade but sometimes it is a fallen angel that we will continue to hold. There are two reasons we would continue to hold a fallen angel, it could be that we expect a full recovery to investment grade or we could be positioning for a more opportunistic sale. It is important, in our view, to never put the portfolio in a

position where it is a forced seller of a bond as a forced sale usually amounts to an ill-timed sale. We did have one credit in our portfolio get downgraded to fallen angel status during the month of March and we have elected to hold it for the time being as our research indicates that the pricing of the bonds is significantly below the fair market value. We expect more volatility in the BAA-rated portion of investment grade as we navigate economic uncertainty and

we expect our underweight will serve us well from a relative performance perspective.

Fed to the Rescue

The actions of the Federal Reserve have been extremely beneficial to the restoration of confidence in the bond markets. On Monday, March 23 the Fed announced a primary market and a secondary market corporate credit

facility. These actions were in response to turmoil within the commercial paper market and lack of liquidity for bond ETF redemptions. The timing could not have been better as the market ended the previous week with an extremely heavy tone so it was a moment of much needed confidence and the Fed stepped up and delivered exactly what was needed.

Tomorrow and Beyond

Tomorrow brings uncertainty; of that much we are certain. We expect continued volatility, particularly in the energy sector and in lower quality BAA rated credit. We are also optimistic and hopeful. We believe that we will come together, not just as a country, but as a civilization, to defeat the global pandemic. We take comfort in the fact that thousands of the smartest people in the world are currently working on solutions. We do not expect it to be easy and it may even take longer than expected but we know that we will eventually prevail. We believe now that a recession is inevitable so our credit selection is even more discerning than it usually is though we always look to position the portfolio in a manner to ensure it can perform through a full market cycle. A big question on investors’ minds is what will the recovery look like? Our view is that it will probably be less of a “V” and more of a “U” making credit selection paramount as it is important that companies within the portfolio have the balance sheet wherewithal to navigate an extended recovery.

We are sanguine on the current valuation of credit spreads. After closing at a high of 373 on March 23, the OAS on the corporate index ended the quarter at 272. This compares to the 5yr average of 128, the 10yr average of 140 and the average since 1988 inception of 135. Clearly credit has been repriced for the challenges that lie ahead and it has become a “credit pickers” market where a skilled active manager can make a difference.

As always please do not hesitate to call or write us with questions or concerns. We hope that you and your loved ones remain in good health during this difficult time.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

i The Financial Times, March 19, 2020 “Asset manager rocked by record bond outflows”

ii Institutional Investor, March 19, 2020 “The corporate bond market is “basically broken” Bank of America says”

iii Bloomberg, April 1, 2020 “IG ANALYSIS US: Record setting March ends with $13 billion bang”

iv ICE BAML Index Data, April 1, 2020

v J.P. Morgan, March 23, 2020 “Fallen angel risk in this crisis”