CAM Investment Grade Weekly Insights

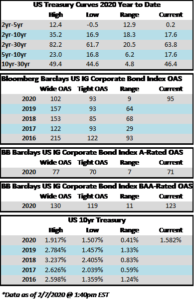

Spreads for corporate credit were generally tighter on the week. After closing the week prior at a spread of 102, the Bloomberg Barclays Corporate Index closed Thursday evening at a spread of 96. The tone at mid-day Friday is mixed as risk markets continue to weigh the impact of coronavirus. Treasuries were volatile over the course of the past week. The 10yr closed at 1.51% last Friday which was its lowest level of the year. The benchmark rate then closed as high as 1.65% this Wednesday and is now fluttering around 1.58% on Friday afternoon.

The primary market had a fair week as corporate borrowers issued over $21bln in new debt. 2020 issuance has eclipsed $154bln according to data compiled by Bloomberg.

According to Wells Fargo, IG fund flows during the week of January 30-February 5 were +$9.0bln making it the largest 5-week total for fund flows on record. This brings year-to-date IG fund flows to over $36bln. Both domestic and global investors continue to favor U.S. credit markets as one of the last bastions for reasonably safe yield.