CAM Investment Grade Weekly Insights

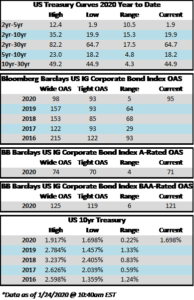

Spreads drifted 2 basis points wider on the week with the OAS on the corporate index moving from 93 to 95. Fears of a global health crisis drove Treasuries to 2020 lows and the 10yr is currently trading at 1.698% as we go to print, its lowest level of 2020.

It was another solid week for the primary market as over $25bln in new debt was priced. January issuance has now topped $123bln which is up 46% relative to 2019’s pace according to data compiled by Bloomberg. New deals of all stripes have been well oversubscribed and while there were still new issue concessions available they were quite slim, typically just a few basis points.

According to Wells Fargo, IG fund flows during the week of January 16-22 were +$4.8bln. This brings year-to-date IG fund flows to over $20bln. This is the third consecutive week of strong inflows into the IG credit market.

(Bloomberg) Delayed Disclosure of Biggest Corporate Bond Trades Stalls

- S. regulators have halted a plan to test whether delayed disclosure of corporate bond trades would boost market liquidity after a powerful group of investors, including Vanguard Group Inc., Citadel and AQR Capital Management, slammed the proposal.

- A Wall Street trade group informed its members late last year that the Financial Industry Regulatory Authority’s controversial plan had been put on hold, said two people familiar with the matter. The brokerage watchdog could still make changes and go forward after consulting with the Securities and Exchange Commission, another person said.

- Finra’s plan was to review the impact of giving traders two full days before having to reveal so-called block trades — the largest transactions. Some of the biggest money managers, such as Pacific Investment Management Co. and BlackRock Inc., have argued that a requirement that block trades be reported within 15 minutes has made it harder for banks to profit from facilitating buying and selling. That has prompted Wall Street securities firms to retrench, making it harder for buy-side participants to execute trades.

- Finra first proposed its study in April 2019 and gave the public until June 11 of last year to provide feedback. The regulator has said little about the test in the seven months since the comment period expired.

- Corporate bond trades are revealed through Finra’s Trade Reporting and Compliance Engine, better known as Trace. The regulator introduced the system in 2002 with the goal of increasing transparency, as most transactions have historically taken place over the phone between buyers and sellers.

- A common refrain among Wall Street banks is that rules passed in the wake of the 2008 financial crisis made it harder and more expensive for them to hold large inventories of corporate bonds. That has prompted banks to function mostly as intermediaries that link up buyers and sellers, rather than purchasing big blocks of bonds from investors and then unloading the debt over time for a profit.

- Vanguard disputes those claims. In its letter, the asset-management giant said there’s no proof that prompt disclosure of trades is hurting liquidity. But it is clear, according to Vanguard, that increased transparency lowers transaction costs. It called the proposed study “a harmful solution to an unsubstantiated problem.”

(Bloomberg) Investors Just Keep Pumping Cash Into Corporate Bond Funds

- Credit bond funds continue to rake in cash as investor appetite for risk remains voracious.

- Buyers pushed $4.2 billion into high-grade funds for the week ended Jan. 22, according to Refinitiv Lipper. That’s on top of last week’s $6.6 billion influx and a record $8.2 billion inflow from the prior reporting period.

- This month’s sum covering the first three weeks of the year — a whopping $19 billion — already exceeds last year’s full-month January inflow total by about $5 billion.

- Seemingly insatiable demand has kept the high-grade primary market hot as some new bond deals come in as much as seven times oversubscribed and secondary spreads stand at the tightest level since February 2018.