CAM Investment Grade Weekly Insights

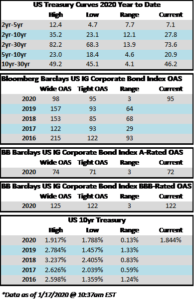

It was another busy week in the corporate credit markets; inflows remained robust, the new issue calendar continued to hum and the secondary market featured buyers grabbing for yield. Risk markets have been incredibly resilient as they have shrugged off geopolitical turmoil and they seem to have little interest in impeachment or the upcoming presidential primaries and election. The spread on the corporate index is one basis point tighter on the week, currently trading at 95. The range in spreads on the index thus far in 2020 has been tight at just three basis points.

The primary market was busy again with more than $35bln in new debt coming to market on the heels of $60bln+ the week prior. Demand was very strong as order books were well oversubscribed, even for companies with marginal credit metrics. It is early in the year but so far new issue supply is 32% higher relative to last year, according to data compiled by Bloomberg. Recall that CAM’s projection as well as the general consensus is calling for overall supply in 2020 to be down relative to 2019 especially on a net basis. We expect that issuers will look to be quite active in the first half of the year and that issuance will be more subdued in the second half due to the uncertainty that typically accompanies a presidential election. The consensus supply number for January is $120bln, according to data compiled by Bloomberg, so next week should be another solid week for issuance but will likely be somewhat lower than the previous two weeks due to earnings blackout periods.

According to Wells Fargo, IG fund flows during the week of January 9-15 were +$5.5bln. This brings year-to-date IG fund flows to over $15.5bln, a strong start to the year.

(Bloomberg) That $1 Trillion BBB Powder Keg Worries Credit Investors Again

- Investors raised doubts about BBB debt in late 2018, when General Electric Co. was in crisis, its bonds tanked, and investors fretted about market turmoil from mass downgrades. Those fears proved misplaced last year, when investors stampeded into BBB notes and crushed risk premiums on the securities to around their lowest level since the financial crisis. Those narrow risk premiums are what worry at least some money managers.

- Because BBBs make up more than half the $8.4 trillion investment-grade corporate markets in both the U.S. and Europe, there’s that much more debt at risk of possibly falling to speculative grade. In 1993, BBBs were more like a quarter of the market.

- Signs of trouble for BBB companies have started brewing this year. Italian infrastructure company Atlantia SpA lost its last remaining investment-grade rating this week, and Boeing Co.’s biggest Max supplier, Spirit AeroSystems Holdings Inc., has also fallen into junk.

- Some money managers are focusing on finding bargains among BBB notes. Many of the largest BBB constituents gorged on debt to fund M&A, bringing their total obligations in 2018 to around $1 trillion, according to a Bloomberg analysis. Some of those companies have put debt reduction at the forefront, selling assets and cutting dividends to free up cash. That helped make GE, AT&T and AB InBev among 2019’s best corporate bond investments.