CAM Investment Grade Weekly Insights

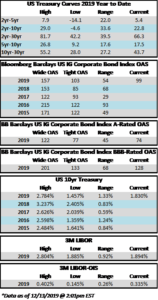

The grind continues as the OAS on the Bloomberg Barclays Corporate Index breached 100 for the first time in 2019 with a 99 close on Thursday evening. The index has not traded inside of 100 since March of 2018 and has averaged a spread of 127 over the past 5-years and 113 over the past 3-years. Treasuries were again volatile on the week, especially Friday, which saw a range of 15 basis points on the 10yr Treasury. However, as we type this during the late afternoon on Friday it appears that the 10yr is going to end the week almost entirely unchanged from the prior weeks close.

The primary market has entered year-end Holiday mode. Less than $4bln in new debt was brought to market during the week. The first half of next week is the last chance for meaningful issuance in the month of December. According to data compiled by Bloomberg, 2019 issuance stands at $1,110bln which trails 2018 by 4%.

According to Wells Fargo, IG fund flows during the week of December 5-11 were +$5.4bln. This brings YTD IG fund flows to +$282bln. 2019 flows are up over 10% relative to 2018.