CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

9/6/2019

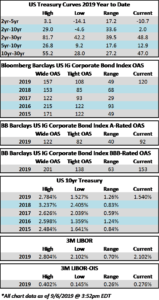

Spreads are set to finish the week tighter, a remarkable feat considering the tsunami of new issue supply. The OAS on the corporate index closed at 120 on Thursday after closing the prior week at a spread of 120 but as we go to print on Friday afternoon spreads have ground tighter throughout the day. The 10yr Treasury is 1.54%, essentially unchanged on the week but it had traded as low at 1.45% on Wednesday before positive headlines related to trade sparked a sell-off into the Thursday open.

The primary market just capped off the busiest week in its entire history, and in a holiday shortened week with a jobs report to boot. Corporate borrowers brought over $75bln in new debt during the week, smashing the previous 2013 record of $66bln. According to data compiled by Bloomberg, year-to-date corporate supply stands at $840bln. After having trailed 2018 issuance by as much as 13% in June, 2019 year-to-date issuance is now down just 2% from the prior year. The fact that secondary market spreads tightened amid such staggering supply speaks to the insatiable demand for IG U.S. corporate credit.

According to Wells Fargo, IG fund flows during the week of August 29-September 4 were +$4.4bln. This brings YTD IG fund flows to +$202bln. 2019 flows to this juncture are up 7.7% relative to 2018.