CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

8/16/2019

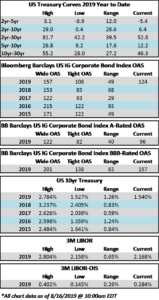

Spreads are likely to finish wider for the second consecutive week. The OAS on the corporate index is at 124 this morning after closing the prior week at a spread of 120. Spreads opened the previous week at 113, so the move wider in credit has been meaningful over the course of the past two weeks, but this move has largely been overshadowed by lower Treasuries. The 10yr is wrapped around 1.54% as we go to print after having closed the week prior at 1.74%. The 10yr closed the month of July at 2.01%. The move lower in rates has been quick and intraday ranges have been volatile with the 10yr trading below 1.5% on Thursday while the 30yr traded below 2% for the first time in history. For all the volatility in rates and spreads the corporate market has a positive tone as we go to print Friday morning. There are not many sellers of corporate credit while buyers are plentiful. This has made it difficult to find attractive bonds in recent weeks but we at CAM are chipping away and finding select opportunities in credit.

The primary market continues to show resiliency amid a volatile tape. Corporate borrowers brought $23bln in new debt during the week, pushing the month to date total north of $64bln. According to data compiled by Bloomberg, year-to-date corporate supply stands at $754.7bln, which trails 2019 supply by 6%. The primary is set to enter a quiet period for the final two weeks of August before ramping up after Labor Day. September has historically been among the strongest months for the new issue calendar.

Fund flows into investment grade corporates were strong for the second consecutive week. According to Wells Fargo, IG fund flows during the week of August 8-14 were +$5.4bln. This brings YTD IG fund flows to +$174bln. 2019 flows to this juncture are up 6.7% relative to 2018.

(Bloomberg) Investors Rushed to High Grade as Recession Fear Spooked Markets

- Investors dove into U.S. investment-grade corporate bond funds during a week when fears of a global economic slowdown rose and trade-related headlines brought wild swings in stocks, credit and Treasuries.

- Investors plowed $4 billion into high-grade funds for the week ended Aug. 14, according to Refinitiv’s Lipper. It was the biggest inflow since June, as U.S.-China trade headlines continued to rattle markets and concerns about a slowing global economy inverted a key portion of the U.S. Treasury yield curve for the first time in 12 years. High-yield funds posted a modest inflow of $346 million.

- Investment grade has become the best performing asset class in fixed income with returns of over 13% so far this year, according to the Bloomberg Barclays US Corporate Total Return index.

- The high-grade primary market has also remained steadfast during the volatility in recent weeks. With the exception of Wednesday, when issuers sidelined themselves during the rout, debt borrowers have been able to sell bonds at cheaper funding costs.

- Last week investors yanked over $4 billion from junk bond funds, the most since October, while adding $2.8 billion to high-grade funds.