CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

8/9/2019

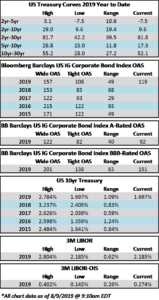

Spreads in the corporate market are set to finish the week meaningfully wider as the OAS on the index opened at 113 on Monday and is trading at 119 as we go to print on Friday morning. Rate volatility was as the forefront this week as the rates market has more carefully considered the impact of a full blown trade war. The 10yr Treasury closed at 1.85% last Friday and is wrapped around 1.70% as we go to print this morning. Spreads opened the month of August at year-to-date tights of 108 and have now moved 11 wider, but at the same time the 10yr Treasury is 30 basis points lower, so the net effect is lower yields for corporate credit. While the Fed cut the federal funds rate by 25bps last Wednesday, the market expectation is that this is merely the beginning of a multi-cut easing cycle. Federal funds futures are now implying 2 additional cuts by the end of 2019 and 2 more by the end of 2020. At CAM, we are of the belief that it is quite possible that markets are underestimating the probability of a lack of near term trade resolution and the associated impact that a prolonged trade dispute could have on risk assets.

Even amid heightened volatility and uncertainty, the primary market was quite active during the week. In fact it was the fifth busiest week of the year that also saw Occidental Petroleum print the 4th largest bond deal of the year which was met with robust investor demand. While spreads are set to finish the week meaningfully wider it is clear that there is solid demand for corporate credit, particularly higher quality issuers. According to data compiled by Bloomberg, year-to-date corporate supply stands at $731.9bln, which trails 2019 supply by 6%. It is worth noting that for most of 2019 supply has trailed 2018 by 10-12% but this gap has narrowed in recent weeks. The M&A pipeline continues to grow and it would not surprise us at CAM if issuance were robust through the end of September which could continue to push issuance totals toward 2018 levels.

Fund flows into investment grade corporates escalated throughout the week. There was a clear bifurcation between the high yield and investment grade credit markets as flows during the week were driven by a flight to quality. According to Wells Fargo, IG fund flows during the week of August 1-August 7 were +$3.3bln while high yield funds experienced losses of -$3.7bln over the same time period and leveraged loan funds posted outflows of -$963 million. This brings YTD IG fund flows to +$169bln. 2019 flows to this juncture are up 6.5% relative to 2018. The fact that flows are up while new issue supply is down is but one factor that has led to a supportive environment for credit spreads.