2019 Q2 High Yield Quarterly

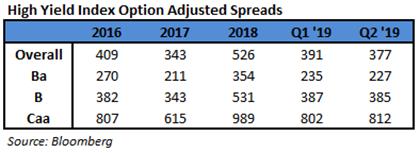

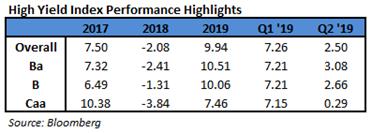

In the second quarter of 2019, the Bloomberg Barclays US Corporate High Yield Index (“Index”) return was 2.50% bringing the year to date (“YTD”) return to 9.94%. The CAM High Yield Composite gross total return for the second quarter was 3.59% bringing the YTD return to 11.07%. The S&P 500 stock index return was 4.30% (including dividends reinvested) for Q2, and the YTD return stands at 18.54%. The 10 year US Treasury rate (“10 year”) spent most of quarter in rally mode finishing at 2.01% and down 0.40% from the beginning of the quarter. During the quarter, the Index option adjusted spread (“OAS”) tightened 14 basis points moving from 391 basis points to 377 basis points. There was a massive 210 basis points of widening that took place in Q4 2018 and since that time, the OAS has tightened 149 basis points. During the second quarter, the higher quality segments of the High Yield Market participated in the spread tightening as BB rated securities tightened 8 basis points and B rated securities tightened 2 basis points. The lowest quality segment, CCC rated securities, widened 10 basis points.

The Banking, Finance, and Insurance sectors were the best performers during the quarter, posting returns of 4.64%, 4.11%, and 3.87%, respectively. On the other hand, Energy, Other Financial, and Basic Industry were the worst performing sectors, posting returns of -0.92%, 1.01%, and 1.66%, respectively. At the industry level, supermarkets, environmental, p&c insurance, and life insurance all posted the best returns. The supermarkets industry (5.35%) posted the highest return. The lowest performing industries during the quarter were oil field services, independent energy, retail REITs, and chemicals. The oil field services industry (-4.37%) posted the lowest return.

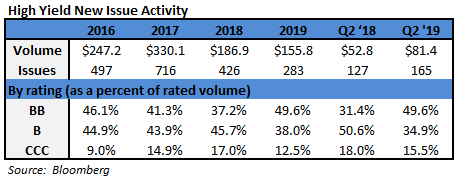

During the second quarter, the high yield primary market posted $81.4 billion in issuance. Issuance within Consumer Discretionary was the strongest with 22% of the total during the quarter. The 2019 second quarter level of issuance was much more than the $52.8 billion posted during the second quarter of 2018. When 2019 is complete, there is little doubt that the final issuance for the year will surpass the $186.9 posted during all of 2018.

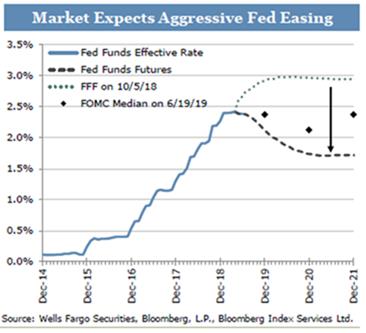

The Federal Reserve held two meetings during Q2 2019, and the Federal Funds Target Rate was held steady at both meetings. While the Target Rate didn’t move, the real story was the continued shift in messaging by the Fed. The January FOMC statement showed that the Fed was at least thinking about the end of rate increases. i The March FOMC statement moved further in that direction with officials acknowledging weaker economic reports and downgrading their GDP estimates.ii At a conference in early June, Chairman Powell pushed forward the idea of possible rate cuts.iii The market has taken notice and, as of this writing, investors are pricing in a 100% probability of a cut at the FOMC July meeting.iv As can be seen in the chart at the left, the Fed is still currently out of step from what the market is expecting. While we are interest rate agnostic and do not attempt to time interest rate movements, we are very aware of the impact Fed policy has on the markets. Therefore, we will continue to monitor this very important theme throughout the rest of this year and into 2020.

While the Target Rate moves tend to have a more immediate impact on the short end of the yield curve, yields on intermediate Treasuries decreased 40 basis points over the quarter, as the 10-year Treasury yield was at 2.41% on March 31st, and 2.01% at the end of the quarter. The 5-year Treasury decreased 46 basis points over the quarter, moving from 2.23% on March 31st, to 1.77% at the end of the quarter. Intermediate term yields more often reflect GDP and expectations for future economic growth and inflation rather than actions taken by the FOMC to adjust the Target Rate. Inflation as measured by core CPI has been trending lower since the 2.4% print in mid-2018. The most recent print was 2.0% as of the June 12th report. The revised first quarter GDP print was 3.1% (quarter over quarter annualized rate). The consensus view of economists suggests a GDP for 2019 around 2.5% with inflation expectations around 1.9%.

Besides the Fed’s more dovish messaging, the rising trade tensions between the US and China was another major theme over the course of Q2. Throughout the quarter, both countries were increasingly posturing in order to bolster their negotiating position. However, the market was well aware of the G20 meeting taking place in Japan at the end of June. It was likely that new information would come out of a meeting between President Trump and China’s leader Xi Jinping. Now that the G20 has taken place, regarding the trade talks, Trump said “we’re right back on track.”v It has been universally reported that the meeting between the two leaders was very productive on many of the contested issues. However, at this point, it is very probable that the topic of global trade will remain at the forefront of investors’ minds for quite some time.

Being a more conservative asset manager, Cincinnati Asset Management is structurally underweight CCC and lower rated securities. This positioning has served our clients well so far in 2019. As noted above, our High Yield Composite gross total return has outperformed the Index over the second quarter and YTD measurement periods. With the market remaining robust during the second quarter, our cash position remained the largest drag on our overall performance. Additionally, our underweight positioning in the communications, banking, and finance sectors were a drag on our performance. Further, our credit selections within the communications sector and automotive industry hurt performance. However, our underweight in the energy sector and overweight in the consumer noncyclical sector were bright spots. Further, our credit selections within the midstream, consumer services, and healthcare industries were a benefit to performance.

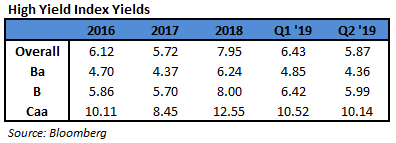

The Bloomberg Barclays US Corporate High Yield Index ended the second quarter with a yield of 5.87%. This yield is an average that is barbelled by the CCC rated cohort yielding 10.14% and a BB rated slice yielding 4.36%. Equity volatility, as measured by the Chicago Board Options Exchange Volatility Index (“VIX”), oscillated a bit throughout the quarter but finished about where it started with a reading of 15. High Yield default volume remained low during the second quarter with only six issuers defaulting. The twelve month default rate was 1.46%. vi Additionally, fundamentals of high yield companies continue to be mostly good. From a technical perspective, supply has increased from the low levels posted in 2018, and flows have been positive relative to the negative flows of 2018. Due to the historically below average default rates, the higher yields available relative to other spread product, and the diversification benefit in the High Yield Market, it is very much an area of select opportunity that deserves to be represented in many client portfolio allocations.

With the High Yield Market remaining very firm in terms of performance, it is important that we exercise discipline and selectivity in our credit choices moving forward. While the first quarter displayed similar returns acrossthe quality buckets, the second quarter began to show investors differentiating a bit on the lower quality spectrum as the CCC bucket underperformed the broader market. As more differentiating creeps into the high quality buckets, it is expected that opportunities for our clients will be presented. The market needs to be carefully monitored to evaluate that the given compensation for the perceived level of risk remains appropriate on a security by security basis. It is important to focus on credit research and buy bonds of corporations that can withstand economic headwinds and also enjoy improved credit metrics in a stable to improving economy. As always, we will continue our search for value and adjust positions as we uncover compelling situations.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

i Bloomberg January 30,2019: “Fed Folds as Message Shifts to Peak from Pause”

ii Bloomberg March 20, 2019: “Powell’s FOMC Turns Pessimistic and Passive”

iii Bloomberg June 4, 2019: “Powell Signals Openness to Fed Cut”

iv Bloomberg July 1, 2019, 4:00 PM EDT: World Interest Rate Probability (WIRP)

v The New York Times June 29, 2019: “5 Takeaways From the G20 Summit” vi JP Morgan July 1, 2019: “Default Monitor”