CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

6/7/2019

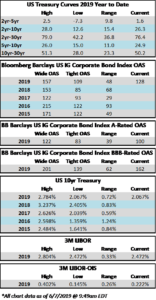

It was a bit of a see-saw week in the corporate market as the tone was very heavy on Monday but sentiment turned decidedly more positive on Tuesday and remained so throughout the rest of the week. The OAS on the corporate index opened the week at 128 and widened to 130 going into Tuesday morning but we sit back at the 128 level as we go to print on Friday morning. The biggest story of the week is Treasury yields, which are lower across the curve for the second consecutive week. The 10yr Treasury is over 5 basis points lower on the week and sits at its lowest level of 2019 and the lowest levels we have seen since September 2017.

$23.4bln in new corporate debt was brought to the market this week. New issue concessions remain low, having averaged 3.5bps thus far in 2019 according to data compiled by Bloomberg. Of course, every deal is different and some deals have enjoyed more substantial concessions than others. Year-to-date corporate supply has crossed the half trillion mark and sits at $511.1bln, which lags 2019 issuance by over 9% according to data compiled by Bloomberg.

According to Wells Fargo, IG fund flows during the week of May 30-June 5 were +$6.2bln. This brings YTD IG fund flows to +$125bln. 2019 flows to this juncture are up 4.8% relative to 2018.

(Bloomberg) Fiserv’s Expected Jumbo M&A Deal Makes an FX Pivot

- A highly-anticipated Fiserv jumbo M&A bond deal never materialized Thursday as the company announced plans for a European roadshow, calling into question how big the dollar leg will be. Many had expected up to a $12 billion transaction funded solely in the U.S. currency. Meanwhile, two deals moved forward pricing $810 million.

- While it didn’t bring a deal, Fiserv did, unexpectedly, announce a EUR and/or GBP roadshow just as Mario Draghi was declaring that the ECB won’t shy away from action to support the euro-area economy during a period of weakening growth. A dovish ECB and low rates potentially going lower may have contributed to Fiserv’s decision to test alternative currencies. We have seen a surge in reverse yankee issuance for exactly this reason

- The stage seemed set for Fiserv to bring high-grade’s first jumbo deal since Bristol-Myers and IBM priced nearly $40b in acquisition-related funding for Celgene and Red Hat, respectively. Equity futures were in the black, IG CDX opened tighter and Wednesday’s two biggest deals from HCA and Parker-Hannifin were trading though new issue levels after achieving strong primary pricing outcomes. From an economics perspective, if you’re a believer in the correlation of ADP and nonfarm payrolls, Thursday offered a brief window ahead of a potentially weak jobs report. This, all amid an irrefutably stronger primary market backdrop that had steadily improved over the week.

- Should Fiserv elect to predominantly tap the European debt capital markets it will be the second time in under a month that an issuer bringing an M&A deal has gone overseas for the majority of the funding. Fidelity National Services elected to fund just USD1b after launching EUR5b and GBP1.25b for their Worldpay acquisition. People with knowledge of the deal expected a much larger greenback portion. So much so that the USD-leg was more than 8 times oversubscribed in less than two hours.

(Bloomberg) U.S. Payrolls, Wages Cool as Trade War Weighs on Economy

- S. employers added the fewest workers in three months and wage gains cooled, suggesting broader economic weakness and boosting expectations for a Federal Reserve interest-rate cut as President Donald Trump’s trade policies weigh on growth.

- Nonfarm payrolls rose 75,000 in May after a downwardly revised 224,000 advance the prior month, according to a Labor Department report Friday. The increase missed all estimates in Bloomberg’s survey calling for 175,000. The jobless rate held at a 49-year low of 3.6% while average hourly earnings climbed 3.1% from a year earlier, less than projected.

- The dollar and Treasury yields fell as the data signaled the labor market — a pillar of strength for an economy headed for a record expansion — was facing new pressures even before Trump threatened tariffs on Mexican goods in addition to proposed higher levies on Chinese imports. Retail sales, factory output and home purchases have shown the economy struggling this quarter after better-than-expected growth in the first three months of the year.

(Forbes) Intel Charts A New Course With 10th Gen Core And Project Athena

- Likely the most anticipated product that Intel revealed at Computex was its 10th Gen Core processors code-named Ice Lake. These 10th Gen Core processors utilize a new Sunny Cove CPU architecture and are built with Intel’s much awaited 10nm process node, which previously had some issues regarding yields that Intel claims are now resolved. Intel says these issues are behind them and that we can see volume production of 10nm with this 10th Gen of Core processors. These new Ice Lake processors also feature the new Gen11 graphics chip, which should elevate Intel’s performance in integrated graphics further to enable even better entry-level gaming. The 10th Gen Core processors announced at Computex range from Core i3 up to Core i7, with up to 4 cores and 4.1 GHz max turbo frequency. These processors target 2-in-1 and thin and light laptop form factors, so having a 4.1 GHz max turbo frequency AND 1.1 GHz GPU frequency is quite impressive.

- Intel claims the Iris Plus graphics inside of the 10th Gen core processors (based on their Gen11 graphics) provide double the performance over the previous generation in some benchmarks. The company also claims double the HEVC encode performance, which should help with creative people wanting to do on-the-go video editing. Additionally, Intel claims double the FPS in 1080P games. While this would obviously be a pretty significant improvement, it will likely depend heavily on how the thermals are managed by the device manufacturer and over what period.

- Intel also integrated both Thunderbolt 3 and Wi-Fi 6 into the 10th Gen Core processors, which is a pretty big deal for those who care about connectivity. Wi-Fi 6, formerly known as 802.11AX, is the future of Wi-Fi and will bring significant improvements to the quality of service, performance, and efficiency. Intel and others are doing the industry a favor by aggressively pushing the standard. Integrating Wi-Fi 6 will help to increase the adoption of Wi-Fi 6 and improve the user experience of PC users. The more users with Wi-Fi 6 devices on a Wi-Fi 6 network, the more efficient the network becomes. Everyone’s speeds (including non-Wi-Fi 6 users) go up. There are also coverage and quality benefits to Wi-Fi 6, but those are more dependent on the access point. Thunderbolt 3’s integration is also important because it is an incredibly versatile high-bandwidth interface that helps improve a device’s modularity with things like docks, displays, and drives.

- OEMs will launch systems with the 10th Gen Core processors this holiday season, which is a bit later than one would expect with a May announcement. With the new process node and design principals, the 10th Gen Core processors are poised to usher the company into a new era.

(Bloomberg) Duke Energy Gets Nod From Indiana Regulator for Solar Pilot

- Duke Energy received approval from the Indiana Utility Regulatory Commission for a pilot program that allows some customers lease solar energy facility from Duke for up to 20 years.

- Initial capacity limited to total of 10 megawatts for customers

- Duke installs, operates, owns and maintains facility

- Customers receive all of the kilowatt-hour output of solar energy equipment through net-metering arrangement