CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

05/17/2019

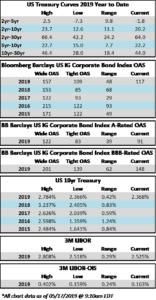

The tone in the credit markets was mixed this week. The market felt heavy on Tuesday amid trade ramifications but by the time Thursday rolled around the tone was quite strong. All told it looks as though we will finish the week relatively unchanged as far the spread on the index is concerned. There are more negative headlines regarding China trade as we go to print on Friday which is leading to weakness in equity markets while Treasury’s are gaining. The 10yr is modestly lower on the week and remains below 2.4% on Friday morning.

Just under $30bln in new corporate debt was brought to the market this week. Demand for new issuance has been solid and thus concessions were low, in the neighborhood of 3-5 basis points for most deals. Year-to-date corporate supply is up to $468bln, which lags 2019 issuance to the tune of -6.3% according to data compiled by Bloomberg.

According to Wells Fargo, IG fund flows during the week of May 9-May 15 were +$4.2bln. This brings YTD IG fund flows to +$114bln. 2019 flows to this juncture are up 4.43% relative to 2018.

(Bloomberg) Bond Traders Need to Up Their Game as AI Systems Get Smarter

- Money is pouring into artificial intelligence in bond markets, challenging bankers and investors to adapt their skills in everything from issuing to trading securities.

- Fintech startup Nivaura is investing in technology to automate debt sales. Dutch bank ING Groep NV is improving systems to help traders buy and sell bonds, while AllianceBernstein Holding LP advanced its virtual assistant to identify notes that people miss.

- After taking over stocks, computers are slowly overcoming resistance in one of the most technology-averse corners of financial markets. Bond traders are wary of a one-size-fits-all approach coming from equity markets, which are now largely automated. They say that human relationships are at the center of the market and clients want to talk through complex transactions.

- AI has proved particularly useful in replacing manual tasks such as inputting data and executing small, liquid trades in markets such as currencies. It’s only just beginning in areas like corporate bonds, that traders call “high touch” for the traditional level of human involvement.

- Still, proponents say tech is being used as a tool by people rather than a replacement for them and that it helps firms use human resources more efficiently.

(Bloomberg) In a Tariff-Muddled World, U.S. Treasuries Send a Clear Message

- Investors are wrestling with mixed U.S. data, underwhelming global growth, and an escalating trade war. While other asset classes have telegraphed optimism, sovereign debt is signaling a degree of caution, if not abject fear, about what comes next.

- While U.S. stocks are barely down on the week through Thursday after collapsing on Monday, Treasury yields are decisively lower. Bund yields aresolidly sub-zero. Chinese sovereign debt is being heralded as a clear winner in the clash over cross-border commerce.

- Another note of caution for Treasury bulls betting on an extension of the rally: expectations that the Federal Reserve is poised to ease – and perhaps materially – by the end of 2020 has helped juice the rally in longer-term debt. But patience – the central bank’s mantra – is almost definitionally incompatible with a proactively accommodative posture.

- Even Minneapolis Fed President Neel Kashkari – arguably the most dovish member of the FOMC – does not think a so-called “insurance” rate cut is appropriate. A more hawkish member – Kansas City chief Esther George – thinks a rate reduction could fuel financial excesses.

- If the market switched to betting the Fed will stay on hold this year, and if 10-year yields moved in lock-step with fed funds futures, then 10-year Treasuries would be north of 2.60% and trading closer to the 2019 highs than the trough.

(Bloomberg) Walmart Rallies on Plan to Pass on Cost of Tariffs to Consumers

- Comparable sales for Walmart stores in the U.S. climbed 3.4% in the first quarter, its best for the period in nine years. Sales of groceries — Walmart’s biggest business — fueled the increase, and a later-than-usual U.S. flu season boosted health and wellness products. The shares rose as much as 4.1% Thursday in New York, the biggest intraday gain in almost three months.

- Walmart’s response to potential higher levies will likely set the tone for other discount retailers, and its decisions on whether to pass along or absorb the additional costs will have ripple effects on American consumers. In its favor, Walmart’s clout with suppliers gives it more room to maneuver, and much of its food comes from U.S. sources, easing the impact.

- “We will do everything we can to keep prices low, but increased tariffs lead to increased prices,” Chief Financial Officer Brett Biggs said in a Thursday morning interview. “It’s very item- and category-specific. There are some places where as we get tariffs, we will take prices up.” Finding alternative manufacturers “is one of a number of actions that our merchants are considering.”

- Walmart’s response to potential higher levies will likely set the tone for other discount retailers, and its decisions on whether to pass along or absorb the additional costs will have ripple effects on American consumers. In its favor, Walmart’s clout with suppliers gives it more room to maneuver, and much of its food comes from U.S. sources, easing the impact.

- “We will do everything we can to keep prices low, but increased tariffs lead to increased prices,” Chief Financial Officer Brett Biggs said in a Thursday morning interview. “It’s very item- and category-specific. There are some places where as we get tariffs, we will take prices up.” Finding alternative manufacturers “is one of a number of actions that our merchants are considering.”