CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

03/15/2019

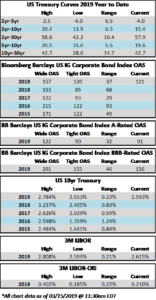

The investment grade credit markets look to finish the week marginally tighter. After opening the week at 123, the OAS on the corporate index closed on Thursday at 121, near the YTD low of 120. The 10yr Treasury is 4 basis points lower on the week as we go to print and it is 15 basis points lower than where it closed on the first trading day of March.

It was yet another solid week of issuance as IG firms issued just over $25bln in new corporate debt during the week. New issue concessions remain razor thin and in some cases turned negative as investors “pay up” for the liquidity that it is afforded by the availability of new debt. At the midpoint of the month, $64bln in new debt has been issued which brings the YTD tally to $268.498bln according to data compiled by Bloomberg.

According to Wells Fargo, IG fund flows during the week of March 7-March 13 were +$4.9 billion. This brings YTD IG fund flows to +$49.968bln. 2019 flows to this juncture are up 1.39% relative to 2018.

(WSJ) $10 Billion Corporate Debt Sale Highlights Credit Market’s Recovery

- The world’s largest maker of automotive batteries is set to sell more than $10 billion worth of speculative-grade debt Friday to fund its purchase by an investor-group led by Brookfield Business Partners LP, underscoring the recent resurgence in demand for low-rated bonds and loans.

- Power Solutions, the automotive-battery business currently owned by Johnson Controls International, is poised to sell roughly $3.7 billion worth of secured and unsecured bonds, denominated in both dollars and euros, along with around $6.5 billion in loans, also split between euro and U.S. dollar tranches.

- The long-anticipated sale is on track to be relatively easy for a large group of underwriting banks, as investors have eagerly embraced what many see as a stable business that is able to shoulder the large amount of debt being placed on it.

- The expected completion of the Power Solutions deal is a testament to the improved tone in high-yield debt markets, several investors said. Though fears of an economic slowdown led to a sharp decline in bond and loan sales in the final months of 2018, issuance picked up in the middle of January and has been fairly steady since then.

- Through Wednesday, businesses had sold a total of $106.9 billion of speculative-grade bonds and loans this year, according to LCD, a unit of S&P Global Market Intelligence. That is down from $162 billion in the same period last year.

- Some investors cautioned that the likely success of the Power Solutions deal doesn’t necessarily mean other businesses will find it as easy to sell such a large amount of debt in the current market. Even using conservative assumptions, analysts expect the company should be able to generate ample free cash flow in the coming years. Its secured bonds and loans, in particular, appealed to investors who have been eager to buy debt at the higher end of the speculative-grade ratings scale.

- Not everything about the deal pleased investors. Prospective buyers were able to make some changes to the package of investor protections, known as covenants, an unusual outcome for such an in-demand deal. Yet the result, some said, still gives the company’s owners plenty of room to pay themselves dividends and remove collateral from the business, in keeping with the long-term trend toward weaker covenants.

(Bloomberg) U.S. Junk Bonds May Be Signaling That It’s Time to Be Cautious

- There are early signs that it’s time to be cautious now in U.S. junk bonds.

- Investors seem reluctant to buy the weakest high-yield corporate securities, a potential signal of trouble ahead, according to Citigroup Inc. strategists. Ratings firms are downgrading speculative-grade companies at the fastest rate relative to upgrades since the start of 2016, according to data compiled by Bloomberg. And to sell their bonds, a handful of issuers including Scientific Games International Inc. have had to pay higher yields this month than dealers had expected.

- For now, many investors are shrugging off those concerns. Junk bonds have reached record highs this year and are the best performing U.S. fixed-income sector, gaining more than 6.4 percent through Wednesday. A Bank of America Corp. survey of U.S. credit-fund managers found the lowest level of alarm about high-yield and investment-grade corporate bonds since 2014.

- A handful of companies including Arrow Bidco LLC and Community Health Systems Inc. are feeling the impact of those concerns. The borrowers had to pay more than dealers expected to entice investors to buy bonds in recent weeks.

- There are other reasons for investors to be cautious now. Economists surveyed by Bloomberg expect growth to slow in the U.S. over the next three years. U.S. corporate earnings growth could come under pressure as tax benefits subside, which should reset junk bond prices and generate “meaningful” negative excess returns in the coming weeks and months, Bank of America said. Corporate bankruptcy filings in the U.S. have jumped, according to a Bloomberg index.

- Warning signs aren’t limited to the U.S. The European Central Bank has slashed its economic expansion forecasts for the region, China has lowered its goal for economic growth, and an increasing number of corporate borrowers there are struggling to repay debt obligations.

- There are still positives for corporate-debt investors. More companies have been getting upgraded to investment grade than getting cut to junk, a trend that’s expected to continue this year, according to Barclays Plc strategists led by Bradley Rogoff. The highest ratings tier now makes up almost 46 percent of the overall junk market, near an all-time high. The size of the junk bond market has been shrinking for more than a year, in part because companies have borrowed more in the loan market, making the securities scarcer. And default rates remain low, although they are rising.