CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

02/15/2019

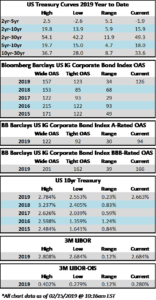

Investment grade spreads tightened modestly throughout the first half of the week before a deluge of new issue supply led the market to take a breather on Thursday. While the tone is positive on Friday morning, the corporate index looks like it will finished the week relatively close to unchanged.

The real story this week was the aforementioned new issue supply. Over $38bln of new debt priced in just three trading days, through Wednesday while no deals priced on Thursday or Friday. Altria led the way this week as it priced $11.5bln on Tuesday and then AT&T came with $5bln on Wednesday. 3M Co, Goldman Sachs, Boeing and Tyson Foods were among the other companies that printed multi-billion dollar deals during the week.

According to Wells Fargo, IG fund flows during the week of February 7-February 13 were +$2.9 billion. This brings YTD fund flows to +$13.312bln.

As far as new supply is concerned, monthly volume projections for February are still calling for ~$90bln of issuance during the month. As we roll past the mid-month mark, we have seen just over $48bln in new supply.