CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

10/26/2018

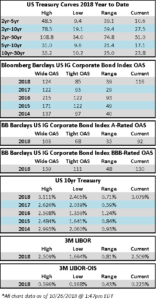

Amid the backdrop of a volatile equity market, corporate credit spreads are meaningfully wider on the week as we go to print, with credit spreads at least 5 wider across the board. On Friday afternoon, the 10yr Treasury stood at 3.08%, which is 11 basis points lower on the week.

According to Wells Fargo, IG fund flows during the week of October 18-October 24 were -$1.6bln. Per Wells data, this was the fourth consecutive weekly outflow for a cumulative total of -$7.2bln over that time period. IG fund flows are now +$96.342 billion YTD.

According to Bloomberg, new corporate issuance on the week was less than $6bln. This was an underwhelming issuance figure relative to market expectations of $15-20bln, with the weak tone of the market keeping issuers at bay. Issuance for the month of October stands at $75bln while YTD issuance is $971.559bln.

(Bloomberg) AB InBev Cuts Payout in Half as Rising Rates Squeeze Debtors

- Anheuser-Busch InBev NV, the world’s largest brewer, cut its dividend in half as it seeks to pay down its $109 billion debt mountain, much of it taken on to acquire rival SABMiller Plc in 2016.

- The Budweiser maker justified its move by pointing to the plunge in emerging-market currencies, which is crimping its cash flow. Third-quarter profit missed analysts’ expectations and sales growth slowed to the weakest pace in more than a year. The stock plunged as much as 9.2 percent amid a global selloff.

- The most generous dividend-payer in the food-and-beverage industry is pulling back to protect itself as the U.S. Federal Reserve increases borrowing costs. The move comes as a number of payments are increasingly in doubt, including that of General Electric Co. Consumer-goods makers with the highest dividend yields include Kraft Heinz Co. and General Mills Inc. Such debt-laden companies are struggling to reduce leverage amid competition from small upstarts.

- AB InBev said the new dividend policy will make it easier to reach its goal of reaching a debt level that’s equivalent to two times earnings before interest, taxes, depreciation and amortization. The brewer may be trying to strengthen its finances in case acquisition opportunities arrive, wrote Nico von Stackelberg, an analyst at Liberum.

- “ABI needs a strong balance sheet to have the debt market’s confidence to do big deals,” he wrote, saying it could allow the brewer to bid for assets from the Castel family if they come on the market. Bordeaux-based Castel Group owns beer assets in addition to businesses in wine and soft drinks.

- The Budweiser maker will use the entire $4 billion it saves to pay down debt, Chief Financial Officer Felipe Dutra told journalists on a call. AB InBev has $1.5 billion of borrowings maturing this year, $3 billion next year and $6 billion in 2020, he said.

(Bloomberg) Japan’s Insurers Aren’t Hedging Their Foreign Bonds Anymore: RBC

- Japanese life insurers are holding more unhedged foreign bonds and their hedge ratios are falling, according to RBC Chief Currency Strategist Adam Cole, supporting his bearish view on the yen.

- Notable participants are Nippon Life, Meiji Yasuda and Mitsui, Cole wrote in note; main exception is Kampo

- The trend was “instrumental in turning us bearish” on the yen and is only becoming “more entrenched”

- Life insurers will ramp up purchases of unhedged bonds when the yen is strong

- RBC sees long-term USD/JPY target of 125; pair traded at ~111.95 as of 9:50am ET

- The desire to cut hedges on existing foreign bonds holding is probably why dips in USD/JPY have been shallow lately, even in severe risk-offs