CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

09/07/2018

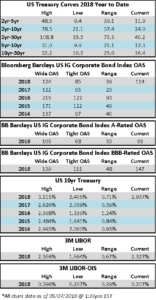

There was plenty of activity in the credit markets this week as the primary market was active right out of the gate on Monday. Contagion fears related to emerging markets weighed on spreads mid-week, particularly high beta, but by the time Friday afternoon rolled around, the spreads of most individual credits were unchanged to modestly tighter.

According to Wells Fargo, IG fund flows for the week of August 30-September 5 were +$1.7 billion. IG flows are now +$93.164 billion YTD.

This was the busiest week of 2018 for investment grade issuance as over $53bln in new bonds were brought to market. Bloomberg’s tally of YTD total issuance stands at more than $826bln.

(Bloomberg) Verizon’s Internet Head Is in Talks to Leave, Dow Jones Reports

- Tim Armstrong, the head of Verizon Communications Inc.’s media and advertising unit, is in discussions to depart as soon as next month, Dow Jones reported, citing unidentified people familiar with the matter.

- Key Takeaways

-

- Armstrong joined in 2015 when Verizon bought AOL and helped steer the acquisition of Yahoo two years later. His departure would be a setback to Verizon’s efforts to build a digital advertising giant.

- There were recent discussions about spinning off Oath, but Verizon decided against it, Dow Jones reported.

-

- Verizon new CEO Hans Vestberg, who took over last month and previously ran Ericsson, is seen as having more of a focus on network technology than on media.

- Key Takeaways

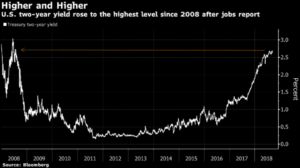

(Bloomberg) U.S. Two-Year Yield Rises to Decade High After Jobs Data: Chart

The yield on two-year Treasuries rose as much as 6 basis points Friday to 2.69 percent, the highest level since July 2008, after the U.S. jobs report for August showed an unexpected uptick in average hourly earnings growth. The better-than-anticipated data are helping to cement expectations for a Federal Reserve rate hike this month, while the odds of an additional increase by year end have also received a boost.

(Bloomberg) Cigna Sells $20 Billion in This Year’s Second-Biggest Bond Sale

- Cigna Corp. sold $20 billion of bonds to fund its takeover of Express Scripts Holding Co., making for the U.S. corporate-bond market’s second-biggest of the year.

- The health insurer issued senior unsecured bonds in 10 parts, according to a person with knowledge of the matter. The longest portion of the offering, a $3 billion security maturing in 2048, yields 1.87 percentage points above Treasuries, after initially discussing around 2.05 percentage points, said the person, who asked not to be identified because talks with potential investors are private.

- The sale is leading what’s been a busy start to September, with some strategists already raising their monthly issuance estimates. Investors, anticipating that a bulging pipeline of M&A deals would bring a wave of debt sales after the summer lull, have been selling debt the past few weeks to make room for new securities, said Travis King, head of investment-grade credit at Voya Investment Management in Atlanta.

- “It’s the kind of deal where everyone is going to feel that they need to own this,” King said before the deal priced. “It’s one of those classic mega deals that gets everyone’s attention.”

- The expected boost in new-issue supply helped boost the amount of yield investors demand to hold corporates instead of government debt, Bloomberg Barclays index data show. Investment-grade bond spreads over Treasuries have widened by 6 basis points since the end of July to 115 basis points.