CAM Investment Grade Weekly Insights

CAM Investment Grade Weekly

07/27/2018

Corporate spreads rallied this week and the corporate index is 6 basis points tighter on the week as we go to print on Friday morning. The tone of the market remains firm this morning.

According to Wells Fargo, IG fund flows for the week of July 19-July 25 were +$1.2 billion. IG flows are now +$77.248 billion YTD.

Per Bloomberg, $9.20 billion of new issuance printed during the week with no deals pending on Friday morning. This was lighter than consensus estimates, which had called for issuance of around $20bln. Earnings blackout most likely played a role in abated issuance. Bloomberg’s tally of YTD total issuance stands at $691.984bn.

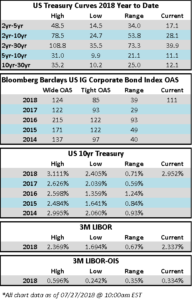

Treasury rates opened higher on Monday but then remained unchanged throughout the week. All told, we are 6bps higher today on 10yrs relative to last Friday’s close.

(WSJ) Prolonged Slump in Bond Liquidity Rattles Markets

- Many bonds around the globe are becoming harder to trade, prompting some investors to shift to other markets and raising concerns about a broad decline in liquidity.

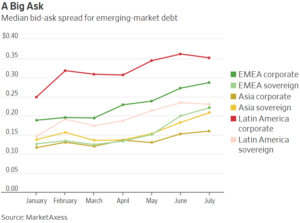

- The median gap between the price at which traders offer to buy and sell, a proxy for the ability to move in and out of markets quickly, has widened this year across European corporate debt and emerging-market government and corporate bonds, according to data from trading platform MarketAxess. Trading in some derivatives has picked up as traders pull back from bond markets they view as increasingly unruly and expensive.

- In May, Italian two-year government-bond yields notched their biggest one-day jump since at least 1989. The surge was triggered by Italian politics, but a lack of liquidity appeared to amplify the moves as the gap between the price at which traders were willing to buy and where they were willing to sell surged to above half a percentage point, according to Thomson Reuters data.

- Alberto Gallo, who runs more than $1 billion in Algebris Investments’ Macro Credit strategy, said it took “around 10 times longer” to unwind a bet on Italian bonds than normal and that it was hard to get bids or offers on trades of more than $10 million in size.

- Liquidity “was bad and it’s remained relatively bad” since May, he said.

- Meanwhile, parts of global bond markets have always had patches of illiquid trading, particularly during bouts of financial-market turbulence.

- But investors say that it is getting worse even in these areas, particularly in emerging markets.

- For dollar-denominated government debt in emerging Europe, the Middle East and Africa, the median bid-ask spread has risen roughly 75% this year to around 22 cents, according to MarketAxess.

- The much larger presence of triple-B-rated debt in the market—the lowest-rated securities still considered investment grade—means that liquidity may be lower than it currently appears given investors may shun riskier securities during times of market stress, according to Gerard Fitzpatrick, Russell Investments’ EMEA chief investment officer.

- “We’ve done some scenario testing there and we think it’s a concern,” Mr. Fitzpatrick said.