CAM Investment Grade Weekly Insights

Corporate spreads moved modestly wider during the week as BBB credit continues to underperform A-rated credit.

According to Wells Fargo, IG fund flows for the week of June 21-June 27 were +$1.3 billion. IG flows are now +$69.387 billion YTD.

Per Bloomberg, it was the slowest week for the new issue calendar thus far in 2018, with only $2.4 billion in new corporate debt priced through Thursday. This brings the YTD total to ~$595bn.

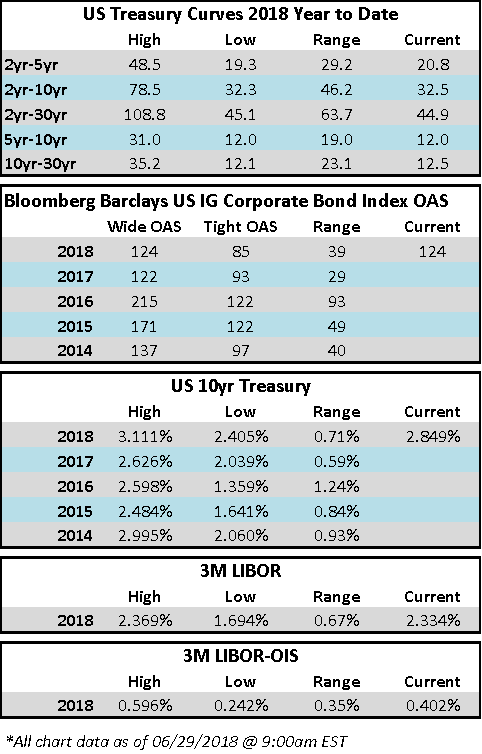

Treasury rates did not change materially this week and curves remain flat.

(Bloomberg) Fed Test Slaps Wall Street Titans, Unleashes Record Payout

- Tougher Federal Reserve stress tests forced some of Wall Street’s top banks to rein in ambitious plans for pumping out cash to shareholders. But even those diminished returns spell a record payout to investors.

- As the central bank’s annual stress tests ended Thursday, the nation’s four largest lenders — JPMorgan Chase & Co., Bank of America Corp., Wells Fargo & Co. and Citigroup Inc. — said they will distribute more than $110 billion through dividends and stock buybacks, sending their stocks higher. Even shares of Goldman Sachs Group Inc. and Morgan Stanley — which the Fed blocked from boosting total payouts — climbed in early trading Friday.

- The Fed’s decisions in the test provided some relief for investors after arecord 13 straight days of declines in the S&P 500 Financials Index. In the hours after clearing the test, more than 20 firms described how they’ll reward their owners over the coming four quarters. Wells Fargo plans to boost payouts more than 70 percent to about $33 billion, while JPMorgan signaled a 16 percent increase to $32 billion.

- The Fed also delivered some bad news. The regulator said it rejected initial proposals from six firms — JPMorgan, Goldman, Morgan Stanley, American Express Co., M&T Bank Corp. and KeyCorp — to make even higher payouts, forcing them to temper their requests. Never have so many firms taken that so-called mulligan to finish the exam.

- The Fed also failed a U.S. subsidiary of Deutsche Bank AG, citing “widespread and critical deficiencies” in its planning. The widely anticipated rejection limits the unit’s ability to send capital home to Germany and comes as senior executives try to bolster investor confidence. The Frankfurt-based firm said it’s working with regulators and making progress.

(Bloomberg) Charter Pays Double-Digit Concession

- Domestic telecom company Charter Communications was the lone issuer to navigate what’s become a treacherous investment-grade primary market.

- Compressing spreads 15bps, CHTR paid 10bps in new issue concession to print $1.5 billion split between 5.5-year fixed- and floating-rate notes when taking into account both their outstanding 22s and 25s.

- New issue fatigue continues to grip the market as investors digest more than $31 billion in jumbo acquisition-related financing from Bayer and Walmart alone. After considering persistent headline risk from global trade tensions, sensitivities around Italy and an upcoming holiday-shortened week, activity is likely to remain muted until the week beginning July 9.

- With just $2.4 billion pricing, we are on pace for the lightest volume week of the year. Prior to this, the last week of May held that distinction with $4.75 billion of sales.

- It was surprising that a split-rated, high-beta telecommunications company elected to move forward today given the recent uneven broader market backdrop and weaker credit landscape.

- Execution can best be described as mixed this week, highlighted by triple-B captive finance issuer Penske Truck Leasing’s 5-year deal stalling Tuesday, launching at initial price thoughts while the borrower was forced to pay elevated concessions.

- As we saw over the last two active sessions, today’s final orderbook was less than 2 times covered.

(Bloomberg) In GE Overhaul, Once-Mighty Finance Arm Goes Out With a Whimper

- General Electric Co.’s finance business was once considered “too big to fail’’ by the U.S. government. These days, John Flannery is trying to make it too small to notice.

- The chief executive officer is selling the bulk of what’s left of GE Capital as part of an effort to remake the parent company into a less volatile — and much smaller — maker of aerospace and power equipment.

- When he’s done, the lending side, which GE has been downsizing since the financial crisis, will consist of a world-class aircraft leasing unit and not much else. It wasn’t that long ago that it offered everything from credit cards and commercial real estate loans to freight-train financing and pet insurance.

- Flannery’s plan, which also calls for spinning off the health-care division and backing out of the oil and gas market, would effectively complete the slow-motion breakup of a banking business that predecessors Jack Welchand Jeffrey Immelt had built into a Wall Street titan.

- Flannery, who spent decades in finance roles at GE, acknowledged the diminishing role of lending at the company but wouldn’t call it the end of GE Capital. After all, there’s still one big business left.

- GE Capital Aviation Services, better known as Gecas, is one of the world’s top plane lessors, with a fleet of almost 2,000 aircraft. The business generated $283 million in profit in the first quarter, while GE Capital overall lost $1.8 billion.

- Flannery has no plans to sell Gecas, which he argues is complementary to GE’s jet-engine manufacturing operations. Still, he said there’s a lot of external interest, giving GE “optionality” down the road. As he put it, potential acquirers “call us constantly.”