CAM Investment Grade Weekly Insights

There was no shortage of news in the market this week with political, economic and monetary policy events. To top it off, on Friday morning we learned that the U.S. and China are now officially in the early innings of a potential trade war, which has pushed the debt and equity markets firmly into risk-off mode as we head to press.

According to Wells Fargo, IG fund flows for the week of June 7-May 13 were +$2.3 billion. IG flows are now +$68.573 billion YTD. Short and intermediate duration funds continue to garner assets while long duration funds have been shrinking this year.

Per Bloomberg, 23.37 billion in new corporate debt priced through Thursday. This brings the YTD total to ~$592bn, which is down 8% year over year.

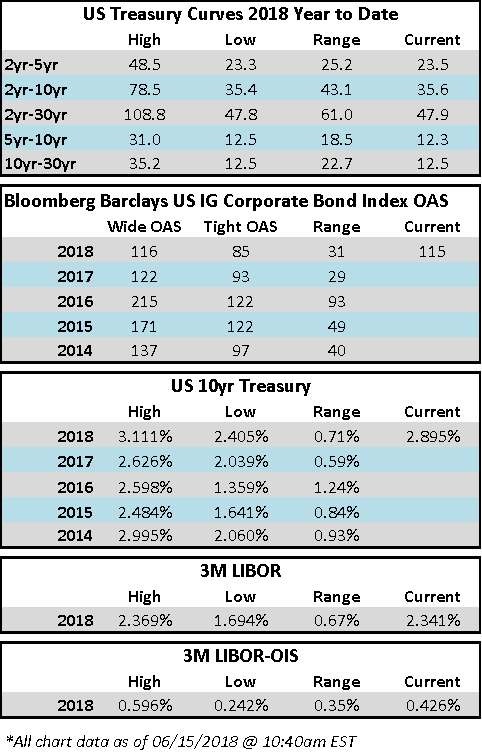

Treasury curves continue to flatten and are now the flattest they have been since 2007.

(CNET) Net neutrality is really, officially dead. Now what?

- The Obama-era net neutrality rules, passed in 2015, are defunct. This time it’s for real.

- Though some minor elements of the proposal by the Republican-led FCC to roll back those net neutrality rules went into effect last month, most aspects still required approval from the Office of Management and Budget. That’s now been taken care of, with the Federal Communications Commission declaring June 11 as the date the proposal takes effect.

- While many people agree with the basic principles of net neutrality, the specific rules enforcing the idea has been a lightning rod for controversy. That’s because to get the rules to hold up in court, an earlier, Democrat-led FCC had reclassified broadband networks so that they fell under the same strict regulations that govern telephone networks.

- FCC Chairman Ajit Pai has called the Obama-era rules “heavy-handed” and “a mistake,” and he’s argued that they deterred innovation and depressed investment in building and expanding broadband networks. To set things right, he says, he’s taking the FCC back to a “light touch” approach to regulation, a move that Republicans and internet service providers have applauded.

- What’s net neutrality again?

- Net neutrality is the principle that all traffic on the internet should be treated equally, regardless of whether you’re checking Facebook, posting pictures to Instagram or streaming movies from Netflix or Amazon. It also means companies like AT&T, which is trying to buy Time Warner, or Comcast, which owns NBC Universal, can’t favor their own content over a competitor’s.

- So what’s happening?

- The FCC, led by Ajit Pai, voted on Dec. 14 to repeal the 2015 net neutrality regulations, which prohibited broadband providers from blocking or slowing down traffic and banned them from offering so-called fast lanes to companies willing to pay extra to reach consumers more quickly than competitors.

- Does this mean no one will be policing the internet?

- The FTC will be the new cop on the beat. It can take action against companies that violate contracts with consumers or that participate in anticompetitive and fraudulent activity.

- So what’s the big deal? Is the FTC equipped to make sure broadband companies don’t harm consumers?

- The FTC already oversees consumer protection and competition for the whole economy. But this also means the agency is swamped. And because the FTC isn’t focused exclusively on the telecommunications sector, it’s unlikely the agency can deliver the same kind of scrutiny the FCC would.

- What about internet fast lanes? Will broadband providers be able to prioritize traffic?

- The repeal of FCC net neutrality regulations removes the ban that keeps a service provider from charging an internet service, like Netflix or YouTube, a fee for delivering its service faster to customers than competitors can. Net neutrality supporters argue that this especially hurts startups, which can’t afford such fees.

- What’s net neutrality again?

(Bloomberg) AT&T Closes Time Warner Deal After U.S. Declines to Seek Stay

- AT&T Inc. closed its $85 billion takeover of Time Warner Inc., the culmination of a 20-month battle for the right to enter the media business by acquiring the owner of HBO and Warner Bros.

- The completion of the deal came just hours after AT&T made a filing in federal court in Washington disclosing that it had reached an agreement with the Justice Department that waived a waiting period for closing.

- The agreement doesn’t prevent the department’s antitrust division from appealing the decision issued Tuesday by a federal judge rejecting the U.S. antitrust lawsuit against the deal. The government is still weighing whether to appeal the ruling, a Justice Department official said.

- AT&T’s completion of the takeover caps a nearly two-year effort to acquire Time Warner, the owner of CNN, HBO and Warner Brothers studio. The Justice Department sued in November to stop the merger, claiming the combination would raise prices for pay-TV subscribers across the country. After a six-week trial, U.S. District Judge Richard Leon ruled against the government’s case.

(Bloomberg) Powell Lauds Economy as Fed Nudges Up Interest-Rate Hike Path

- Federal Reserve officials raised interest rates for the second time this year and upgraded their forecast to four total increases in 2018, as unemployment falls and inflation overshoots their target faster than previously projected.

- The so-called “dot plot” released Wednesday showed eight Fed policy makers expected four or more quarter-point rate increases for the full year, compared with seven officials during the previous forecast round in March. The number viewing three or fewer hikes as appropriate fell to seven from eight. The median estimate implied three increases in 2019 to put the rate above the level where officials see policy neither stimulating nor restraining the economy.

- Chairman Jerome Powell told reporters following the decision — which lifted the Fed’s benchmark rate by a quarter percentage point to a range of 1.75 percent to 2 percent — that the main takeaway was that “the economy is doing very well.” Powell also announced he plans to start holding a press conference after every meeting in January, cautioning that “having twice as many press conference does not signal anything.” The Fed chief currently speaks to reporters after every other meeting of policy makers.

(Bloomberg) Concho Resources Rides IG Upgrade Bump Again

- Exploration & production company Concho Resources was among Thursday’s top performers, pricing $1.6 billion across 2 tranches to help fund the RSP Permian acquisition. The issuer rode the momentum of its Moody’s ratings hike from HY to IG Monday pricing flat to its outstanding credit curve.

- CXO last accessed the debt capital markets in September pricing a whopping 25bps inside its curve after amassing more than $11 billion in orders. That deal came on the heels of an S&P upgrade to investment grade from HY.

(WSJ) Disney, Comcast Bids for Fox Assets Could Face Regulatory Sticking Point: Sports

- Comcast Corp. CMCSA and Walt Disney Co. DIS -0.54% are fighting to win over 21st Century Fox Inc. FOX shareholders and acquire major assets of Rupert Murdoch’s media empire. After the boardroom fight comes the next battle: winning over Washington.

- Both bids are expected to get a close look from antitrust regulators at the Justice Department, which earlier this week suffered a bruising loss when a judge approved AT&T Inc.’s acquisition of Time Warner Inc. with no conditions.

- The Justice Department’s antitrust chief said Wednesday he wouldn’t let the outcome deter him from challenging other deals. “I don’t think our case or evidence or theories were flawed,” Makan Delrahim said, adding that “a different judge could have ruled completely differently.”

- Comcast executives have begun reaching out to Fox and Comcast shareholders to make their case for the merger, people familiar with the matter say.

- Because Disney and Comcast, like Fox, produce television shows and movies, either deal would represent a horizontal merger, in which direct rivals combine, further limiting the number of competitors in the industry.

- The sports assets that would be combined in either a Disney-Fox or Comcast-Fox deal will get heavy scrutiny. Fox is selling nearly two-dozen regional sports networks including in New York, Los Angeles and Detroit. Its marquee property is the YES Network, the television home of the New York Yankees. Fox’s regional sports networks have been valued at $23 billion by industry analysts.

- Comcast’s nine regional sports networks carry local teams in major markets such as Philadelphia and Chicago. Its SNY, the home of the New York Mets, competes for advertisers with Fox’s YES. The addition of Fox’s channels would make Comcast the home for local sports in just about every major television market. That could potentially give it leverage in negotiations with other distributors for the rights to carry those channels. However, the channels for the most part don’t compete against one another.

- Disney doesn’t operate any local sports channels, but it owns ESPN, which has several national channels and rights to just about every major sport. The addition of Fox’s 22 regional channels could give it tremendous clout both locally and nationally with pay-TV distributors, sports leagues and advertisers.

- Neither proposed deal includes the Fox Broadcasting network, its local TV stations, the Fox News and Fox Business channels or the national sports channel Fox Sports 1. The broadcast businesses in particular would have likely made either deal virtually impossible to get past regulators because Disney owns ABC and Comcast owns NBC.

(WSJ) PG&E Cut To BBB By S&P; Still May Be Cut Further

- S&P said the cut reflects the incremental weakening of the business and financial risk profile after CAL FIRE’s determination that PG&E’s equipment was involved with 16 of the Northern California wildfires in late 2017.

- S&P said it could resolve the negative CreditWatch in the near term when CAL FIRE determines the cause of the Tubbs fire, or if there is a legislative solution to inverse condemnation that materializes in the legislative session ending August 2018