CAM Investment Grade Weekly Insights

Fund Flows & Issuance: According to Wells Fargo, IG fund flows for the week of April 26-May 2 were positive, with an inflow of $2.6 billion. According to data analyzed by Wells Fargo, IG funds have garnered $59.1 billion in net inflows YTD.

According to Bloomberg, $21.775bn in new corporate debt priced during the week. This brings the YTD total to $430.595bn.

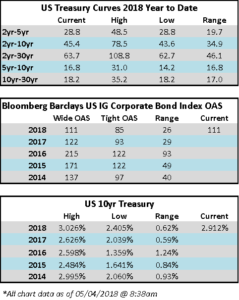

The Bloomberg Barclays US IG Corporate Bond Index closed on Thursday with an OAS of 111, a new YTD wide. The 10yr treasury rallied this week and now sits at 2.914% as we go to print, after reaching a high of 3.026% the week prior.

(Bloomberg) U.S. Payrolls Rebound to 164,000 Gain; Jobless Rate Hits 3.9%

- U.S. hiring rebounded in April and the unemployment rate dropped below 4 percent for the first time since 2000, while wage gains unexpectedly cooled, suggesting the labor market still has slack to absorb.

- Payrolls rose 164,000 after an upwardly revised 135,000 advance, Labor Department figures showed Friday. The jobless rate fell to 3.9 percent, the lowest since December 2000, after six months at 4.1 percent. Average hourlyearnings increased 0.1 percent from the prior month and 2.6 percent from a year earlier, both less than projected.

- Despite the softer-than-expected wage reading, an unemployment rate drifting further below Federal Reserve officials’ estimates of levels sustainable in the long run may in their view add to upward pressure on wages and inflation. That would keep the central bank on track to raise interest rates in June for the second time this year and potentially one or two more times after that in 2018.

- The results may also reinforce forecasts for a rebound in economic growth this quarter after a slowdown in the first three months of the year, with the labor market supporting gains in consumer spending that may be further fueled by tax cuts. Companies in industries from services to manufacturing are hungry for workers, indicating hiring is likely to stay solid.

- The median estimate of analysts was for a gain of 193,000 jobs, with projections ranging from 145,000 to 255,000. Revisions to prior reports added a total of 30,000 jobs to payrolls in the previous two months, according to the figures, resulting in a three-month average of 208,000.

(Bloomberg) High-Grade Index Sets New 2018 Wide

- Credit continues to leak wider, underscored by the Bloomberg Barclays IG OAS index setting a new 2018 wide mark of +111 Thursday, a level not seen since September. The HY index also closed at the widest level in nearly a month. The IG primary market was active yesterday with more than $8 billion pricing, dominated by corporate borrowers.

(Bloomberg) Flipkart Board Is Said to Approve $15 Billion Walmart Deal

- The board of Flipkart Online Services Pvt has approved an agreement to sell about 75 percent of the company to a Walmart Inc.-led group for approximately $15 billion, according to people familiar with the matter, an enormous bet by the American retailer on international expansion.

- Under the proposed deal, SoftBank Group Corp. will sell all of the 20-plus percent stake it holds in Flipkart through an investment fund at a valuation of roughly $20 billion, said the people, asking not to be named because the matter is private. Google-parent Alphabet Inc. is likely to participate in the investment with Walmart, said one of the people. A final close is expected within 10 days, though terms could still change and a deal isn’t certain, they said.

- That would seal a Walmart triumph over Amazon.com Inc., which has been trying to take control of Flipkart with a competing offer. Flipkart’s board ultimately decided a deal with Walmart is more likely to win regulatory approval because Amazon is the No. 2 e-commerce operator in India behind Flipkart and its primary competitor. Amazon is out of the running unless Walmart hits unforeseen trouble.

- If completed, the deal will give Bentonville, Arkansas-based Walmart a leading position in the growing market of 1.3 billion people and a chance to rebuild its reputation online. The world’s largest retailer has struggled against Amazon as consumers increase their spending on the internet. India is the next big potential prize after the U.S. and China, where foreign retailers have made little progress against Alibaba Group Holding Ltd.