CAM Investment Grade Weekly Insights

Fund Flows & Issuance: According to Wells Fargo, IG fund flows on the week were $3.598bln. This brings the YTD total to +$286.112bln in total inflows into the investment grade markets. According to Bloomberg, investment grade corporate issuance for the week was $47.265bln, and YTD total corporate bond issuance was $1.239t. Investment grade corporate bond issuance thus far in 2017 is down 1% y/y when compared to 2016.

(Bloomberg) Investment-Grade Borrowers Power Through Thick Market

- High-grade issuers continue to shrug off broader market weakness and forge ahead with funding plans. More than 30 investment-grade issuers have tapped the USD market this week, powering through soft market conditions and high supply.

- Each session this week has kicked off with a multi-tranche corporate deal; Apple Inc. (AAPL) $7b 6-part Monday, Oracle Corp. (ORCL) $10b 5-part Tuesday and Johnson & Johnson (JNJ) $4.5b 5-part on Wednesday

- Utilities are having an active week, which was forecast with the completion of this year’s EEI conference.

- Weekly volume is set to top $40b in total volume, a feat not accomplished since early September

(Bloomberg) CenturyLink Dividend Doubts Send Shares, Bonds Plummeting

- CenturyLink Inc.’s shares and bonds plummeted after the telecommunications and Internet provider reduced its full-year forecast, boosting fears among investors that a dividend cut will follow.

- The company said 2017 results would fall short of guidance it provided in February because of lower-than-expected revenue growth as more people gave up on landlines. The shares plunged to their lowest value in seven years and the bonds were the biggest decliners in high-yield debt.

- Analysts peppered company officials with questions on an earnings conference call Wednesday night over the level of the dividend. They asked whether the current payout — 54 cents a quarter — can be maintained even as the company repays debt for its $34 billion acquisition of Level 3 Communications Inc. Regulators last month approved the deal, which CenturyLink hopes will stabilize its business among growing competition from cable companies.

- “CenturyLink’s near-term liquidity is OK,” said Stephen Flynn, a Bloomberg Intelligence analyst. “That said, CenturyLink does have a very large debt load and debt obligations step up significantly starting in 2020.”

- CenturyLink executives said on the conference call that they expect cost savings and accelerated growth from the Level 3 acquisition to support the current shareholder payout.

- “We are confident we can continue to pay the dividend while investing in growth and in our network,” Chief Executive Officer Glen Post said on the call.

(Bloomberg) Ebitda Mocked in Sign of How Frothy Debt Markets Have Become

- In an anything-goes world for debt, there’s a new definition for Ebitda: Eventually Busted, Interesting Theory, Deeply Aspirational.

- That’s the tongue-in-cheek assessment of a Moody’s analyst who’s been tracking earnings projections used by companies lately when asking investors for loans. Ebitda really means earnings before interest, taxes, depreciation and amortization, but borrowers have been stretching the limits of what’s acceptable when they tweak their accounting to boost the figure.

- The adjustments — known as “add-backs” in Wall Street lingo — make companies look more creditworthy by increasing revenue and earnings forecasts. They’re legitimate when companies use them to factor out foreseeable or one-time events that might unfairly reduce the number. But in this frothy market, the size and vagueness of some add-backs seen in offering documents are raising eyebrows:

- Eating Recovery Center, which helps people with diet disorders, almost doubled Ebitda through add-backs for a debt sale last month to help finance CCMP Capital’s purchase of a controlling stake in the company. Almost half of the add-backs were calculated on the basis that the company will “capture the true earnings potential” of its expanded treatment centers.

- When whitening-agent firm Kronos Worldwide Inc. asked lenders for 400 million euros last month ($470 million), its earnings formula allowed wiggle room for half a dozen specific future actions, such as mergers, “and any operational changes.” Kronos didn’t say what that means.

- Avantor Inc.’s $7.5 billion financing, also last month, pitched an adjusted earnings figure amounting to a 91 percent hike. The industrial supplierclaimed allowances such as shares awarded to employees as compensation, and operational benefits from a merger.

- GoDaddy Inc.’s offering back in February included 21 ways the web-hosting registration service could adjust Ebitda upward, including repeatable savings and synergies from anything it does, or expects to do, in “good faith” for a two-year period.

- Derek Gluckman, senior covenant officer at Moody’s Investors Service who floated the cheeky definition for Ebitda, said frustrated investors have little choice but to buy because of the overheated market. “We are seeing the prolonged effects of the persistent supply-demand imbalance for loans, which favors the borrowers enormously,” Gluckman said.

- Traditional add-backs let borrowers include future savings from cost-cutting or increases in revenue in their Ebitda. There’s nothing illegal or underhanded about the practice, and the offerings clearly lay out exceptions to potential creditors.

- But in a market that’s already in danger of boiling over, aggressive attempts to make companies appear more creditworthy could be masking the true amount of leverage in the system — and the pain for investors if the loans go sour. On top of that, the Trump administration is seeking to dial backregulations aimed at curtailing leverage, and a move is afoot in Congress to review and perhaps kill the current guidance from government agencies.

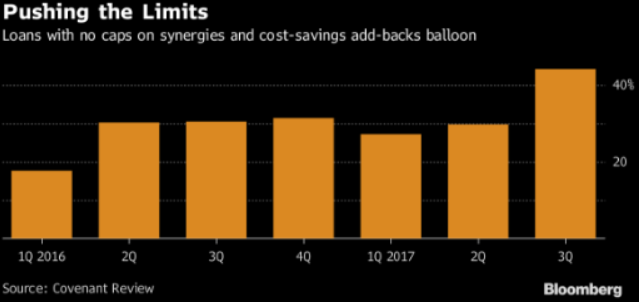

- Add-backs without caps or restrictions for synergies and cost savings spread to 44 percent of new loan deals in the third quarter, from 27.1 percent in the first, according to research firm Covenant Review. In 2017, and each of the two preceding years, 91 percent to 94 percent of North American bonds had at least one Ebitda add-back considered aggressive by Moody’s.

- More aggressive add-backs are one part of a trend toward weakening protections. The quality of covenants, or protections afforded to lenders, in junk bonds is hovering above a record low, according to Moody’s. Leverage levels are also near historical highs at 5.3 times in September, S&P Global Ratings said this week.

(Fierce Wireless) Sprint’s Claure: Tower companies ‘going to be very happy’ with our capex

- The nation’s fourth-largest wireless network operator has lowered its capex guidance several times over the last two years, raising the eyebrows of analysts who have questioned its ability to keep pace with the network upgrades of its rivals. But Son said on Monday that SoftBank not only will increase its stake in Sprint from 83% to 85%, but it will also roughly triple Sprint’s capex to a range of $5 billion to $6 billion beginning in a few quarters.

- Sprint has also been criticized for trying to cut costs by focusing on small cells to densify its network, minimizing its spending on traditional towers. But that strategy hasn’t always been as effective as the carrier hoped, and Claure said Sprint will make macrocells a higher priority as capex ramps up.

- “The last year and a half, two years have been a great learning experience. We’ve tried to disrupt the way networks get built. We’ve been successful in certain areas and, to be fair, we haven’t been successful in others,” he conceded. “So we’re going to go toward a more traditional network build-out. Our friends at the tower companies I think are going to be very happy.”

- Claure added that fewer than half of its towers currently access the carrier’s valuable 2.5 GHz spectrum. Sprint expects all its macrosites to support triband spectrum.

- Sprint still faces a mountain of debt, of course: It’s $38 billion in debt, about half of which will come due over the next four years. But Claure said the carrier’s ongoing cost-cutting efforts continue to prove successful, and its innovative financial mechanisms such as its handset-leasing program and its ever-improving cash position will help finance the network investments.

(Bloomberg) Teva’s Schultz Faces Dwindling Choices as Rating Cut to Junk

- Teva Pharmaceutical Industries Ltd. Chief Executive OfficerKare Schultz is finding himself in the hot seat in his first week on the job with rapidly shrinking options to halt the slide in the Israeli company’s securities after its debt was cut to junk overnight.

- Fitch Ratings cited the “significant operational stress” that the world’s biggest maker of copycat drugs faces at a time when it needs to pay down debt, and pared its rating by two levels to non-investment grade late on Monday. Teva’s debt obligations are almost three times its market value following an ill-timed $40 billion acquisition last year of Allergan Plc’s generics business.

- “We find it troubling that management, which presumably met with Fitch before the downgrade, was not able to convince the rating agency that it would take more dramatic deleveraging actions in order to preserve investment grade ratings,” Carol Levenson, an analyst at bond research firm Gimme Credit, said in a report.

- Kare Schultz

- The company will have to either sell assets or find external sources of financing to meet its obligations, Fitch said. Sales of Teva’s biggest drug, Copaxone, are under siege after a cheaper copycat version of the multiple sclerosis medicine entered the U.S. market last month. Schultz, who took the helm at the start of this month, has pledged to increase profits and cash flow.

- While Teva has enough free cash flow and proceeds from asset sales to pay down short-term debt, tackling longer-term leverage could be much more difficult. With the stock down 70 percent this year, issuing straight equity is an increasingly less attractive financing option. That may leave hybrid securities like mandatory convertibles the best source of new capital, Levenson said.

- Fitch downgraded the company’s debt rating to BB from BBB-. Standard & Poor’s and Moody’s Investors Service have both assigned it the lowest investment-grade rating, and all three have warned another downgrade is possible.

- Teva Bonds Already Trading at High-Yield Levels

- Teva’s most liquid 10-year equivalent bonds are the Baa3/BBB- rated 3.15% unsecured notes due in October 2026, which have fallen 10 points from recent highs to the mid-80s, implying a yield of 5.2%, +290 bps. Using Bloomberg Barclays HY Index, BB bond spreads are less than 10 bps wide of 10-year lows of +192 bps on Oct. 24 and single B spreads of about +330 bps. Teva 2.2% unsecured notes due July 2021 are trading at a spread of +250 bps. In yield terms, Teva 2.2% unsecured notes due July 2021 are approaching 4.5%. (11/08/17)

- Teva Bonds Already Trading at High-Yield Levels

(Bloomberg) Fixed 5G was tested by the cable industry, and it came up a bit short

- One of the hottest topics in the wireless industry right now is whether fixed 5G will be able to replace wired connections like DSL, DOCSIS or fiber. The motivation behind this question is obvious: 5G operators might be able to beam high-speed wireless services into wired rivals’ homes (literally going over the top) to steal broadband internet customers away from providers like Charter and Comcast.

- A wide range of tests and reports by wireless carriers and vendors have found plenty to get excited about in 5G—there’s lots of slideware featuring blazing fast speeds and limitless potential. But a new report from two leading players in the cable industry offers a decidedly more pragmatic picture of the fixed 5G space.

- Although the millimeter wave spectrum bands (generally those above 28 GHz) were initially targeted for 5G deployments, T-Mobile, Sprint and others are now pushing to deploy 5G in bands 6 GHz and below. Indeed, T-Mobile has said its 5G deployment, kicking off in 2019, will go all the way down to 600 MHz.

- However, lower spectrum bands generally transmit less data across farther geographic distances, while higher spectrum bands transmit more data across shorter geographic distances.

- For cable players specifically, the 3.5 GHz CBRS band has generated a significant amount of attention, with Charter detailing its wide range of fixed wireless tests in the band. In their report, Arris and CableLabs noted that the 3.5 GHz band can provide “100s of Mbps of broadband capability” in NLOS conditions at distances up to 800 meters—and those speeds could be raised to up to 10 Gbps through channel aggregation of the full 70 MHz available in a licensed scenario.

- Despite the burgeoning possibilities in the 3.5 GHz band, the report concludes that lower spectrum bands like 3.5 GHz simply won’t be able to keep pace with consumers’ growing demands for data, and will likely be used for backup connections. “For Fixed Wireless Access to be able to compete with Wired Solution, it has to be able to provide Gbps peak rates on both the Downlink and the Uplink. To achieve these peak data rates in a Wireless Access network the only wireless bandwidth available with sufficient contiguous spectrum to meet 3+ Gbps SG [service group] downstream service—if the spectral efficiencies remain under 10 bps/Hz—lies well into LOS-delivered (and near millimeter wave) frequencies (28 GHz, 37 GHz, 39 GHz, 60 GHz and 64-71 GHz). These frequencies offer huge amounts of bandwidth (the unlicensed bands alone in the 60 GHz range can deliver 128 Gbps),” the report states.

- “But these frequencies present some clear technical, operational, and aesthetic challenges,” the authors add.

- Although they have been long neglected, millimeter-wave bands have gained substantial notoriety in recent years. Indeed, Verizon and AT&T have spent several billion dollars this year acquiring millimeter-wave spectrum licenses.

- And for good reason: As the report points out, speeds in millimeter wave transmissions can seem almost magical. “Link capacities of approximately 750 Mbps were achievable in LOS conditions, which were degraded to just under 490 Mbps in adverse weather conditions,” the report states, citing CableLabs tests of transmissions in the 37 GHz band. “Also of particular interest was the maximum link length that can be achieved to deliver service where a LOS link extending approximately 2600 feet while delivering nearly 190 Mbps was demonstrated.”

- However, the report outlines the significant challenges players face in deploying millimeter-wave systems. In its 37 GHz tests, CableLabs found that speeds decreased to around 200 Mbps at 150 feet if signals have to travel through foliage – and those figures slow to below 100 Mbps at 150 feet in dense foliage.

- Rain, snow, wind, window tinting, moving vans and other commonplace objects can all conspire to dramatically reduce the effectiveness of millimeter wave transmissions. “The impact of deciduous and conifer trees (under gusty wind conditions) suggest that the leaf density from the conifer more frequently produces heavy link losses and these, more so at higher carrier frequencies,” the report thoughtfully notes.

- Thus, as is explained in the report, it’s still early days in 5G. Fixed applications in millimeter wave bands are some of the first applications of the technology, but that’s certainly not the only application. And advances in MIMO, beamforming, edge computing and other, related technologies may well push 5G calculations into more appealing territory.

- Nonetheless, it’s definitely worth looking at 5G with a clear pair of eyes.