CAM Investment Grade Weekly Insights

Fund Flows & Issuance: According to Lipper, for the week ended April 5th, investment grade funds posted a net inflow of $4.3bn. Per Lipper data, the year-to-date net inflow into investment grade funds was $43.39bn through April 5th. Per Bloomberg, investment grade corporate issuance through Thursday was $20.1bn with 19 issuers pricing 37 tranches on the week. Investment grade corporate issuance is slightly outpacing 2016 with 2017 corporate issuance up 3% year-to-date. Volume is expected to be lower next week with Easter/Passover holidays.

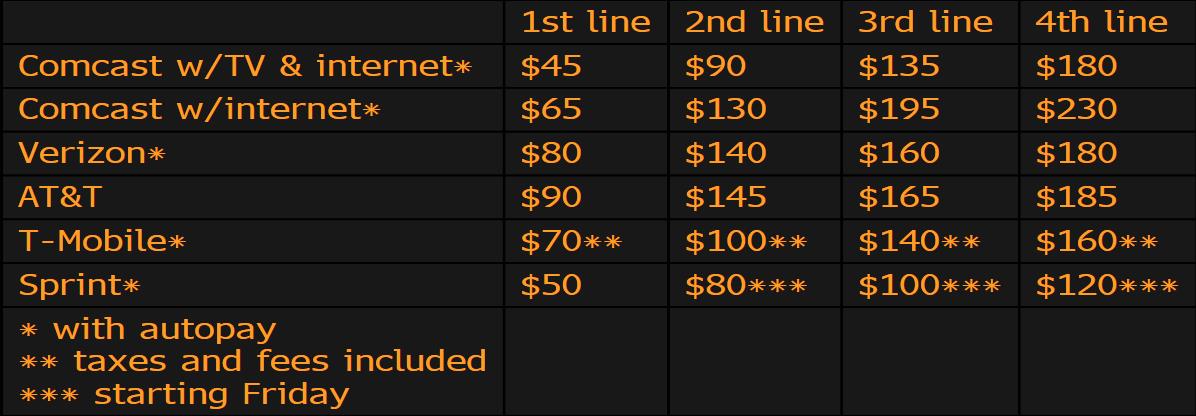

(Bloomberg) Comcast Jumps Into Wireless With $45 Service Undercutting Rivals

- Comcast Corp. unveiled a wireless service that offers unlimited data on Verizon Communications Inc.’s network for less than nearly every other competitor and said the venture will be profitable once it reaches hundreds of thousands of subscribers.

- While the pricing plans have some strings attached and are available only to Comcast’s internet and TV customers, the initial $45 unlimited offer is the lowest among the top U.S. wireless carriers and is likely to further escalate a price war that has ravaged the industry. Shares of the cable giant rose the most in more than two months.

- “The more products you add, the lower the churn,” said Greg Butz, president of Comcast Mobile, using the industry term for monthly subscriber defections.

- Comcast’s entry into wireless comes at a crucial moment for the cable giant. AT&T has moved aggressively onto its turf, offering low-cost TV packages that can be watched on-the-go and don’t count toward monthly data limits. And advances in wireless 5G technology could make surfing the web on phones as fast and reliable as high-speed internet connections at home — a service that has been a major growth area for Comcast.

- Depending on its success in wireless, Comcast could get more ambitious and pursue an acquisition of a wireless carrier such as T-Mobile US Inc., according to some analysts. For now, Comcast says that selling wireless through Verizon’s network is the long-term strategy.

- Unlimited Plans by Carrier (Source: Bloomberg)

(Bloomberg) Monsanto Gets Boost as Takeover by Bayer Looks More Likely

- Monsanto Co., the world’s largest seed company, is getting a boost from increased optimism that Bayer’s $66 billion takeover of the company will go through, as similarly huge transactions between competitors inch toward the finish line.

- Shares of St. Louis-based Monsanto climbed for a third straight day on Wednesday.

- The Bayer-Monsanto combination has more than a 90 percent likelihood of completion, analysts at Citi Research said in a report Wednesday. That outlook comes after Dow Chemical Co.’s $77 billion bid to merge with DuPont Co. cleared antitrust hurdles in the European Union last week, and China National Chemical Corp. just received a green light on its $43 billion acquisition of Swiss pesticide maker Syngenta from the U.S. and the European Union.

- Monsanto Chief Executive Officer Hugh Grant reiterated Wednesday in a call with analysts that a finished deal is expected by year-end. Bayer is planning to place regulatory filings with the European Commission this quarter, and there’s progress with a second round of inquiries with the U.S. Justice Department, he said. Those procedures signal that the deal is progressing, said William Selesky, an analyst at Argus Research Corp. in New York.

- Monsanto’s shares are also up on speculation that the agricultural economy may be better than initially thought. The company on Wednesday reported record fiscal second-quarter earnings amid signs that U.S. farmers are preparing to sow record acreage with soybeans this year.

(Bloomberg) Mexican Beer Boom Sends Shares of Constellation Brands Soaring

- The growing U.S. thirst for imported Mexican beer help send Constellation Brands Inc.’s stock on its biggest rally in three years, even as simmering border tensions threaten to undercut demand.

- The company, which sells Corona, Modelo and other top Mexican brands,posted a 17 percent gain in beer sales last quarter. Constellation’s Ballast Point Brewing & Spirits, which it acquired for $1 billion in 2015, also helped boost revenue.

- In the wake of the growth, Constellation delivered an annual forecast that beat analysts’ estimates. It also raised its quarterly dividend by about 30 percent. The bullish outlook helped allay concerns that the Trump administration will hurt Mexican importers by imposing a border tax or ripping up the North American Free Trade Agreement. Because of its heavy reliance on Mexican beer, Constellation has been seen as one of the most vulnerable companies to policy changes.

- “Our beer business continues to be a powerhouse for growth,” Chief Executive Officer Rob Sands said in a statement. Constellation was the “No. 1 growth contributor to the U.S. beer industry for the year,” he said.

- The company’s wine and spirit sales aren’t growing as quickly as beer. They climbed 6 percent last quarter, helped by the acquisition of the Meiomi and Prisoner brands.

(Bloomberg, Company Press Release) QVC Group to Become Asset-Backed Stock

- Liberty Interactive Corporation (“Liberty Interactive”) (Nasdaq: QVCA, QVCB, LVNTA, LVNTB) and General Communication, Inc. (“GCI”) (Nasdaq: GNCMA) today announced that they have entered into a definitive agreement (the “Agreement”) whereby Liberty Interactive will acquire GCI through a reorganization in which certain Liberty Ventures Group (“Liberty Ventures”) assets and liabilities will be contributed to GCI in exchange for a controlling interest in GCI.

- “We are pleased to announce this transaction with GCI,” said Greg Maffei, Liberty Interactive President and CEO. “GCI is the largest communications provider in Alaska, generates solid cash flow with upside potential and is a strong fit with the largest businesses in Liberty Ventures. This transaction will ultimately create a standalone Liberty Ventures, reducing the tracking stock discount and enabling an asset-backed QVC Group.”

- Liberty Interactive believes an asset-backed QVC Group will provide the following benefits:

- Establish leading pure play discovery based retail and eCommerce company

- Liberty Interactive expected to be renamed QVC Group, Inc.

- Make QVC Group eligible for possible inclusion in stock indices through elimination of tracking stock structure

- Reduce the tracking stock discount

- Increase near-term and annual liquidity through reattribution (discussed below) of approximately $329 million(1) of cash and approximately $130 million annual free cash flow from tax savings related to exchangeable bonds that will grow

- Cash can be used for investments, stock repurchases and debt reduction

- Establish a strong currency that will be a more effective tool for management compensation and retention and for potential future acquisitions

- Maintain strong ability and liquidity to service all debt

- Establish leading pure play discovery based retail and eCommerce company

(Bloomberg) Plenty of Beauty in U.S. Jobs Data Beneath Ugly Headline Number

- For the March U.S. employment report, with its ugly headline payrolls number, it’s what’s inside that counts.

- While the gain of 98,000 jobs in a survey of businesses and government agencies was the weakest since May and below all analysts’ forecasts, many accompanying details showed a solid labor market. The jobless rate, derived from a separate survey of households, fell to the lowest in almost a decade even as workforce participation was unchanged, while a measure of underemployment reached a fresh post-recession low, boding well for further wage increases.

- The March data from the Labor Department on Friday also were challenged by weather anomalies — a storm in the Northeast during the survey week and more seasonable temperatures after two warmer months — that had economists bracing for at least some slowdown in payrolls from a strong start to the year. The reassuring figures elsewhere in the report keep the Federal Reserve on track to continue plans for two more interest-rate increases this year as the labor market continues to tighten.

- The two-month revisions to payrolls subtracted 38,000 jobs, leaving the average so far in 2017 at 178,000. That’s in line with the 187,000 monthly average for all of last year.

- Whether the tight job market triggers the long-awaited wage gains in this almost-eight-year-old economic expansion remains a puzzle. Average hourly earnings increased 2.7 percent in March from a year earlier, just a touch above the average since the start of 2016. That, more than weaker-than-expected employment, might merit more attention in the months ahead.

(Bloomberg) Oil Climbs After U.S. Strike Against Syria Roils Global Markets

- Crude headed for its second weekly gain after briefly spiking in reaction to the first military strike undertaken by President Donald Trump’s administration.

- Futures surged more than 2 percent to the highest in a month in early trading Friday after a U.S. cruise-missile strike against Syria. Gains eased after a weak jobs report fueled concern about the strength of the U.S. economy. Russia’sdeal with OPEC to cut crude supply hasn’t delivered as much as expected, according to Deputy Prime Minister Arkady Dvorkovich. OPEC ministers will gather in Vienna on May 25 to decide whether to extend the accord.